Gold has been a bit reactionary over the past days bouncing around on geopolitical stress and words from the US Federal Reserve Chief. Mario Draghi just a month ago sent the metals market on a whirlwind when the central bank moved to help the eurozone recovery moving to negative interest rates. Lately global stress shifted from Iran to Ukraine and then to Iraq. With tensions between Palestine and Israel reaching war, Iraq has been pushed off the front pages of the papers. Gold peaked just a week ago close to 1350 and tumbled yesterday to below 1295 and stands flat this morning at 1297.10 after Fed Chair Janet Yellen’s testimony before the US Senate. Yellen said U.S. labor markets are far from healthy and signaled the central bank would not be in a hurry to hike interest rates. She emphasized that the U.S. economy needs to be on solid trajectory before the Fed raises rates.

At a recent professional conference I was chatting with my protégé, Scott Carter of Lear Capital. Scott is one of the leading gold experts in the US. He had some very strong opinions about gold and where it should and will be trading. After Goldman Sachs reaffirmed their call for gold to fall to 1280 this year, I thought I would share with my readers some of Scott’s ideas so I asked him to write them down and I will share them with you.

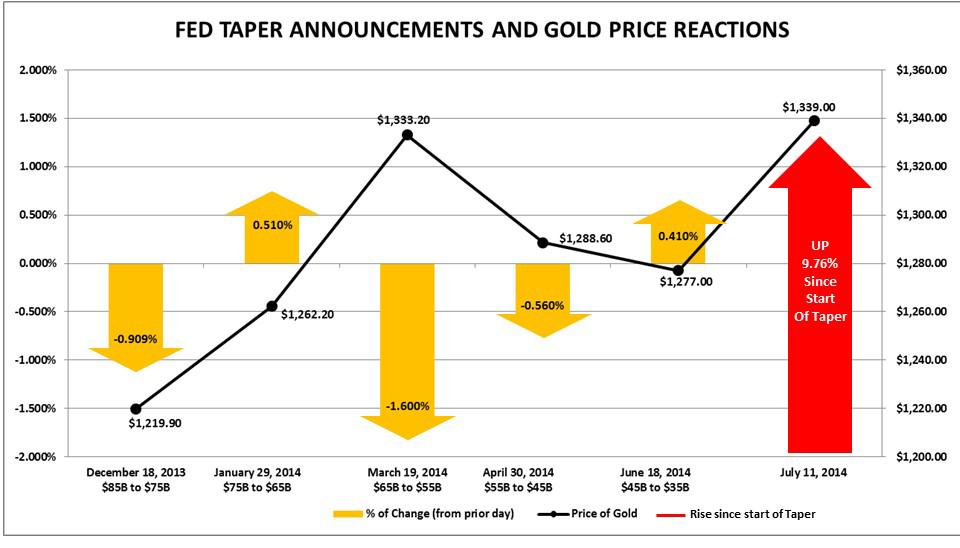

There are several reasons why the long-awaited reduction of QE levels has not negatively affected gold prices or gold demand. Since the Federal Reserve started its draw down of central bank stimulus on December 18th of last year, it has reduced its pace of bond-buying from $85B a month to its current level of $35B, and yet gold has made astonishing gains.

Quantitative Easing, the “save the day” monetary policy of the US Federal government started back in November of 2008 and has pumped some $4.5 trillion into the US economy. This was supposed to stimulate growth, create jobs, and kick start America’s fiscal engine. There is plenty of debate about the degree to which it has been successful. There has been less debate about “QE’s supposed correlation to gold. Long considered a boon to gold prices, most analysts believe that Federal stimulus weakens the dollar and ultimately sends investors flocking to the safety of gold. Conversely, the cessation of QE is supposed to send these same investors scrambling away.

Federal bond-buying has pulled back five times since the start of the taper, but there is no gold-taper price correlation line to be drawn.

Taper announcements on December 18th, 2013 and January 29th, March 19th, April 30th and June 18th, 2014 reveal a series of fairly modest gold dips and rises. Overall, however, gold is up 9.76% since the taper’s kickoff, climbing more than $119 an ounce in the seven months since it commenced.

When the taper was put on the table back in June of last year, Forbes suggested we were looking at $1000 gold. In September, both Citigroup and Morgan Stanley predicted “a waning investor appetite” for gold with one analyst writing, “We maintain a fairly pessimistic outlook for gold as a result of the increased probability of a timetable for the ending of QE.” And finally in December, CNBC posited that that taper was a “nail in gold’s coffin.”

How did the “experts” get it so wrong? If an investor holding $25,000 worth of gold sold their stash at the start of the taper last year, they would have lost almost $2500.

Gold is trending higher in response to a struggling dollar, escalating global conflicts, faltering world banks, as well as some unintended consequences of the taper. Emerging Markets have been hit hard by the reigning in of US monetary policy. The vulnerable “Fragile Five” … Turkey, Brazil, India, Indonesia and South Africa saw large outflows of capital with the onset of the taper as investors diverted money back to the US on the prospect of rising interest rates. As the Fed started to cut its monthly asset purchases, over $100 billion was subsequently pulled out of Emerging Markets. This slowed growth and weakened fledgling EM currencies. These developing economies are the flash points of global growth, making up more than 12% of global GDP. When EM currencies stumble, gold advances as an emerging market hedge furthering adding to its safe haven play.

Needless to say, many financial services groups have had to re-consider their 2014 outlook on gold.The market is revisiting those singular voices that warned that the size and scope of the Fed’s intervention would create dependency and a painful withdrawal that would ultimately hinder the very financial systems that it sought to ease. We are seeing evidence of this first hand as we sit in the slowest recovery since Truman, the highest debt in our history, and dangerously deep cracks in the global economy.

Gold’s 2014 performance taught us something else … that gold buyers are not “announcement” buyers. They do not make investment decisions based upon the short-term fluctuations in currencies, monetary policies, market swings, or the varying positions of central banks. They believe that gold behaves differently and that it is a necessary form of “qualitative easing” possessing inherent and longstanding value. They understand that taper or no taper, the federal government will continue to print, to borrow, and to manipulate money for many years to come.

Bullion buyers understand the disparity between fiat and fixed, paper and metal, and assigned value and intrinsic value.

The question of whether QE has actually caused more harm than good will be hotly debated in business schools and the halls of financial advisory firms for decades to come. For gold buyers, it has had little impact on the long-standing appeal of the world’s oldest money. For those that continued to acquire and hold gold pre-stimulus, post-stimulus and throughout the taper, it remains the final frontier of fundamental value and the last refuge of the long-term investor … while QE has been just another fleeting policy measure in an increasingly policy-heavy system of manipulated paper assets.