- India

- International

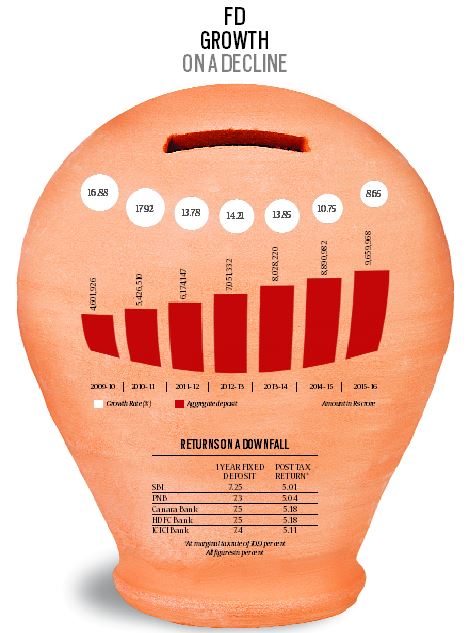

Between the rates: Inflation deflates fixed deposit earnings

Low interest rates being offered by banks on fixed deposits coupled with a relatively high inflation is wiping off the earnings of investors. To minimise the notional losses, experts suggest, investors should look at alternatives.

In case of individuals having a taxable income of over Rs 1 crore, the post-tax return on fixed deposit will come down to 4.9 per cent which is almost 90 basis points lower than the inflation level.

In case of individuals having a taxable income of over Rs 1 crore, the post-tax return on fixed deposit will come down to 4.9 per cent which is almost 90 basis points lower than the inflation level.

The 150 basis point cut in repo rate (at which RBI lends to commercial banks) by the Reserve Bank of India over the last 18-months may have resulted in banks reducing lending rates by up to 80 basis points only, but it certainly has had a significant impact on the interests being offered on fixed deposits.

The fixed deposit rates which hovered around 9 per cent in January 2015 for maturity period ranging between one and three years for various banks, currently stands between 7.25 and 7.5 per cent on deposits of similar tenure. While the interest rates on deposits declined by around 150 basis points over the last 18-months, a simultaneous spike in retail inflation to a 22-month high of 5.77 per cent in June 2016 means that the real rate of return has turned negative for investors falling in the highest tax bracket and thus has also lost its tag of wealth creator.

Experts say that if inflation continues to remain firm and fixed deposit rates retained at current levels then these instruments will only make sense for investors whose income is either non-taxable or if it falls in the lowest tax bracket of 10 per cent.

“As real rate of return on fixed deposits have turned negative, debt investors should look to invest in instruments that continue to beat inflation such as tax-free bonds and small saving schemes,” said Vishal Dhawan, a certified financial planner and founder, Plan Ahead Wealth Advisors.

Surya Bhatia, CFP and founder Asset Managers said that investors should look at more tax efficient debt instruments and can invest into debt schemes of mutual funds where the tax rate is 20 per cent with indexation benefit and is better suited for individuals who fall in the highest tax bracket.

Fixed deposits eating into your savings

As of now, most banks are currently offering an interest rate between 7.25 per cent and 7.5 per cent on their 1-3 year term deposits which is significantly lower from the 9 per cent rate that was being offered 18-months ago. With the decline in offerings, the post-tax return on such deposits have gone further down and have become unviable for a large number of fixed deposit investors. For example if the pre-tax return on a 1-year term deposit is 7.5 per cent then the post-tax return for an individual falling in the 10 per cent tax bracket stands at 6.7 per cent; for the one falling in 20 per cent tax bracket, the post-tax return will stand at 5.96 per cent; and for an individual falling in the highest tax bracket of 30 per cent (taxable income less than Rs 1 crore) will stand at 5.18 per cent.

Now, if we put these numbers against the retail inflation, which stood at 5.77 per cent in June, those in 10 and 20 per cent tax bracket are still getting 1 per cent and 20 basis points, respectively, above the inflation. But, those falling in the highest tax bracket will get more than 50 basis points less than inflation which means negative real rate of return.

In case of individuals having a taxable income of over Rs 1 crore, the post-tax return on fixed deposit will come down to 4.9 per cent which is almost 90 basis points lower than the inflation level.

Decline in investor interest

Realising the declining real rate of return, investors have already slowed down their investments in fixed deposits. While the aggregate year on year deposit growth for all scheduled commercial banks stood at 17.9 per cent in the quarter ended March 2011 and then slowed down to 10.75 per cent in the quarter ended March 2015, in the quarter ended March 2016 the growth stood at a low of 8.65 per cent. It is important to note that even in absolute terms the growth in fixed deposits is lower than that added in the previous three years. While in absolute terms the fixed deposits grew by Rs 8.6 lakh crore in 2014-15, the growth in 2015-16 amounted to Rs 7.68 lakh crore.

Experts say that investors are routing their funds into tax-free bonds and small savings schemes as the returns there are still better. “A large number of fixed deposit investors are now buying tax-free bonds from the secondary market even as they are offering a yield of 6.4-6.5 per cent. This is because the pre-tax return in case of these tax-free bonds will stand at around 9.4 per cent which is much more than those being offered by the fixed deposits,” said Dhawan.

Other than tax-free bonds, investors are also looking at small saving instruments. While the Public Provident Fund is offering an interest rate of 8.1 per cent (tax free), the National Savings Certificate of post office is also offering an interest rate of 8.1 per cent.

Bhatia said that retail debt investors are also looking towards debt schemes of mutual funds which have generated double-digit return over the last one year. In fact, over the last one year, the average pre-tax return generated by medium to long term gilt funds stood at 11.85 per cent, whereas the income funds generated a pre-tax return of 10 per cent, which is significantly higher than the fixed deposit returns.

Even as fixed deposit instruments are fast losing their charm in the current inflationary environment, there is feeling that a good monsoon may help their cause. “A good monsoon may help soften the inflation and if inflation comes down then the real rate of return may turn positive in case of fixed deposits,” added Dhawan.

Apr 20: Latest News

- 01

- 02

- 03

- 04

- 05