Gold Investment Positive, But Only Just

- Gold traded in the narrowest monthly price range for five years, a mere $40 per ounce;

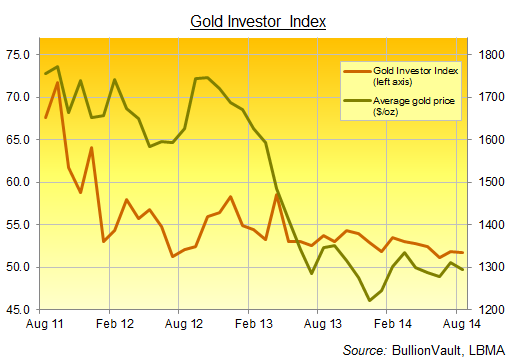

- The monthly average price of $1296 was almost precisely the average gold price of the previous 12 months ($1297.50);

- Speculators and commercial traders both cut their holdings of Comex futures & options. In fact, open interest (ie, the number of contracts now open) fell to a series of 5-year lows;

- Investment funds also shrugged and took to the beach. The giant SPDR Gold Trust (NYSEArca:GLD) shrank by 6 tonnes, reversing July's addition and erasing all 2014 growth so far at 795 tonnes – a 5-year low when first hit this January.

Email us

Email us