Weekly CFTC Net Speculator Gold Report

Gold speculative positions pulled back last week

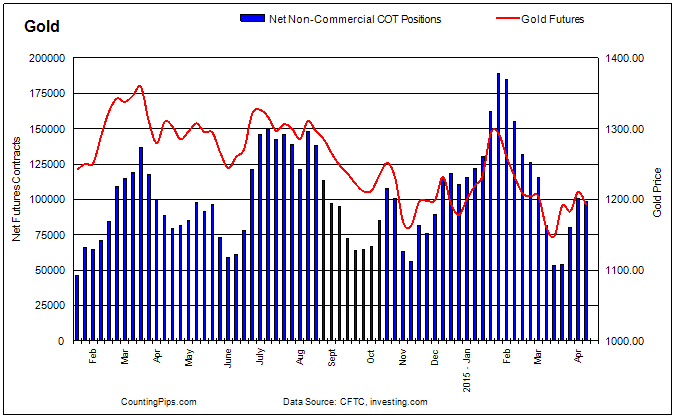

GOLD: Gold speculators and large futures traders slightly trimmed their gold bullish bets last week after pushing bullish bets higher for the previous three weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +98,397 contracts in the data reported through April 14th. This was a weekly change of -2,360 contracts from the previous week’s total of +100,757 net contracts that was registered on April 7th.

The small decline in the weekly net speculator positions (-2,360 contracts) was due to an increase in the weekly bearish positions by 3,971 contracts which more than offset the small rise in the weekly bullish positions by 1,611 contracts.

Last week’s decrease followed two straight weeks of strong gains by over +20,000 contracts that brought the overall net positions to the +100,000 level for the first time since March 3rd.

Over the weekly reporting time-frame, from Tuesday April 7th to Tuesday April 14th, the gold price dipped from approximately $1,210.60 to $1,192.60 per ounce, according to gold futures price data from investing.com.

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators)