Talking Points:

- Gold declined as solid US data supported rate hike

- Oil reversed gains amid ample global supply

- Copper set for a third monthly loss due to demand concerns

The US dollar maintained its gains overnight with data showing a faster pace of growth in the second quarter and a revised advance in the first quarter. Solid data buoyed expectations for an interest rate rise this year which is dollar-positive. As a result, USD-denominated commodities lost ground across the board.

Gold held declines as a solid second quarter GDP bolstered rate hike chances and curbed its appeal. Bullion sets for a biggest monthly drop in two years and is eyeing yesterday’s low at 1082.4, ahead of a five-year low at 1071.2. In a higher interest rate environment, it is harder for gold to compete against return-yielding assets like equities and bonds. Bullion will likely follow a downward path in reverse to an upward trajectory in U.S. interest rate.

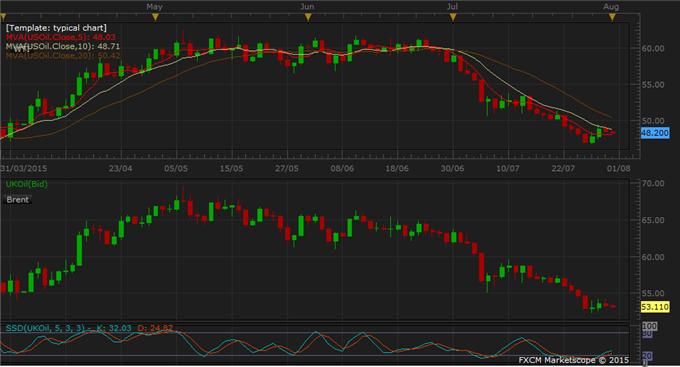

Crude oil reversed gains as adequate global supply downplayed a recent weekly drop in U.S. inventories. U.S. stockpiles are still above the five-year average for this season, while slower economic growth in China fueled concerns that it may curtail demand for oil and industrial metals. Brent also lowered.

Copper headed for a third monthly loss, although it is still up this week amid reports of production disruptions. In contrary to signs of an economic pick-up in the US, China’s economy seems to set for the slowest growth in a quarter of a century. Subsequently, research indicated that China’s copper demand may grow at a slowest pace in almost two decades. China’s benchmark stock index has lost 28 percent since it peaked on June 12, despite a recent recovery after Monday’s stock rout.

GOLD TECHNICAL ANALYSIS – Gold fell below support level at 1085 yesterday and it is eyeing the lower region today. However there is little chance for it to break away from the recent range, with a floor at 1071. Downtrend signal shows signs to resume and that would be good news for the gold bears. Caution should still be exercised before this range is truly broken.

Daily Chart - Created Using FXCM Marketscope

COPPER TECHNICAL ANALYSIS – Copper stayed flat in the Asian morning after it plunged to 2.3570 overnight, which is taken as today’s support level. On the daily chart, copper remains stuck in a correction after a two-month downtrend. In the absence of momentum bias, there is little opportunity for range trade of copper today.

Daily Chart - Created Using FXCM Marketscope

CRUDE OIL TECHNICAL ANALYSIS – WTI oil gave back some of its yesterday’s gains although prices remained above 48 in the Asian morning. WTI and Brent seem to be in a consolidation after their two-month declines. A retracement below 48 may provide opportunity for the oil bears to position shorts if only for range trade.

Daily Chart - Created Using FXCM Marketscope

--- Written by Nathalie Huynh, Currency Strategist for DailyFX.com

Contact and follow Nathalie on Twitter: @nathuynh