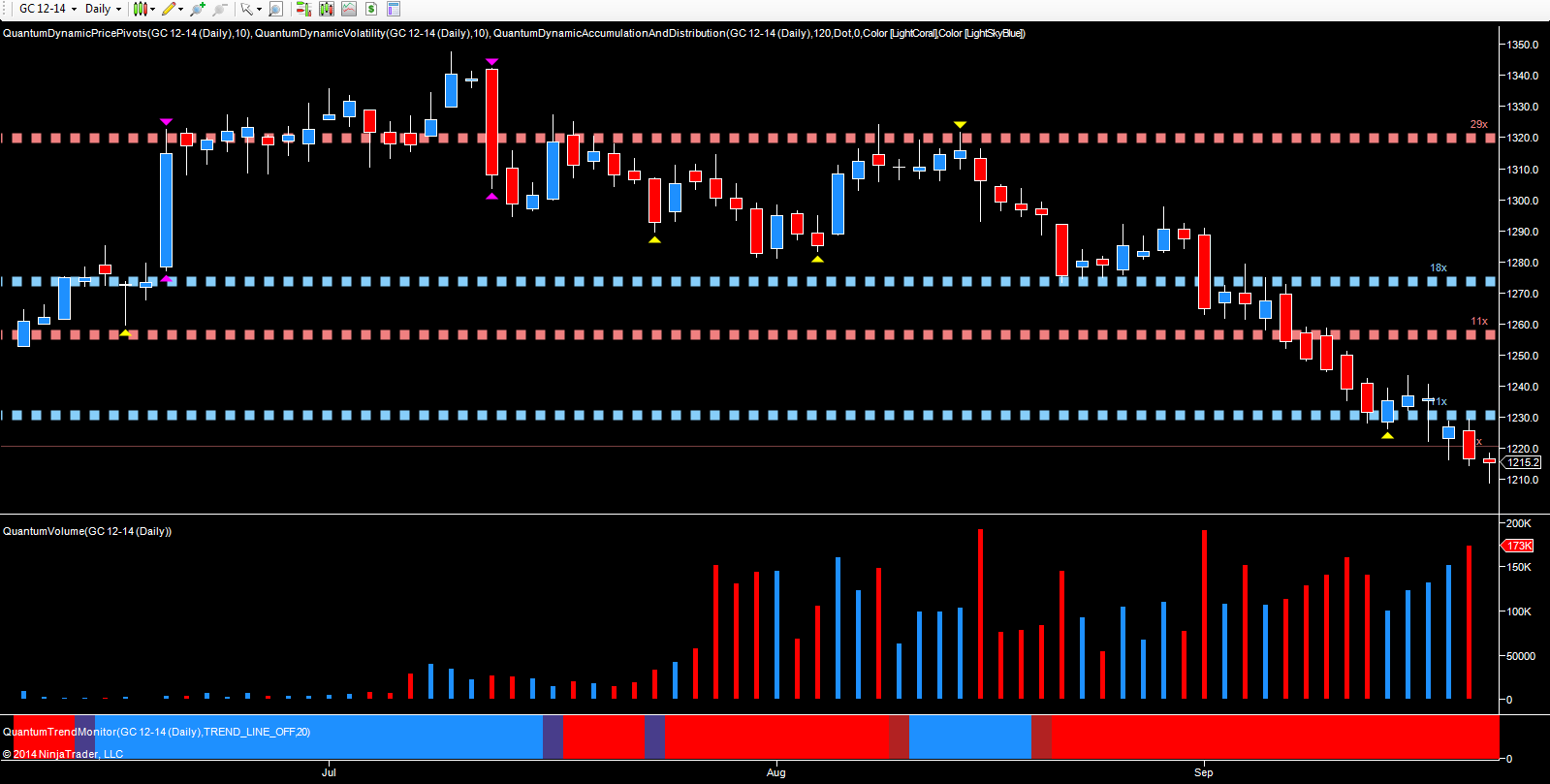

It was another dismal week for gold bugs again last week as the precious metal moved relentlessly lower, with no signals either fundamental, technical or relational, suggesting that the commodity's bearish trend is not coming to an end any time soon. Monday’s modest move higher suggested a possible short term rally, which was duly snuffed out on Tuesday, as the move ran out of steam on rising volume and closing with a deep upper wick to the candle.

The only glimmer of hope at this stage was the support platform in the $1230 per ounce region, which remained unbroken. Wednesday continued to hold above this region, despite testing it during the gold trading session, once again suggesting a possible hold at this level. However, the gap down on Thursday duly shattered this illusion, opening below this potential support on rising volume. Friday’s wide spread down candle finally slammed the door shut with high volumes confirming the heavy selling, with gold closing the week on the December futures contract at $1216.60 per ounce. The negative sentiment has continued once again on Globex overnight, with the metal trading at $1214.70 per ounce at the time of writing.

With so many forces combining to drive gold lower, the prospects for any recovery are unlikely in the short term. The US dollar continues to move higher, driving commodities lower, all reflected in the CRB Index which has fallen from a high of 312.85 in June, to close on Friday at 279.40. For the US dollar, the outlook remains bullish with the index preparing to attack the 85 region and beyond, building on the strong platform of support in the 84.10 area. Any signs of inflation seem a long way off, and even the buying season for gold in India has yet to filter through in any meaningful way. All in all, a dismal picture, and without wishing to be a doom monger, the only trigger at present seems to be the prospect of a market shock and flight to safety – but even this could be a short lived event.

As always, it will be volume which heralds any longer term change in sentiment, and if and until we see a buying climax of some significance, gold now looks set to break below $1200 per ounce and on down to the $1185 per ounce region I have outlined in previous market analysis. If this is breached, then a further leg down seems inevitable.