For the 24 hours to 23:00 GMT, the EUR rose 0.16% against the USD and closed at 1.1075, after Germany’s flash consumer price index advanced to a six-month high level of 0.3% MoM in July, thus offering some sign of relief. Markets expected the index to rise by 0.2%, following a gain of 0.1% in the preceding month. Also, the nation’s seasonally adjusted unemployment rate remained steady at a record low level of 6.1% in July, at par with market expectations. Separately, Euro-zone’s final consumer confidence index remained steady at a level -7.9 in July, in line with investor expectations and similar to its preliminary print.

Macroeconomic data released in the US indicated that, initial jobless claims climbed more-than-expected to a level of 266.0K during the week ended 23 July, compared to market expectations of an advance to a level of 262.0K and after recording a revised level of 252.0K in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1082, with the EUR trading 0.06% higher against the USD from yesterday’s close.

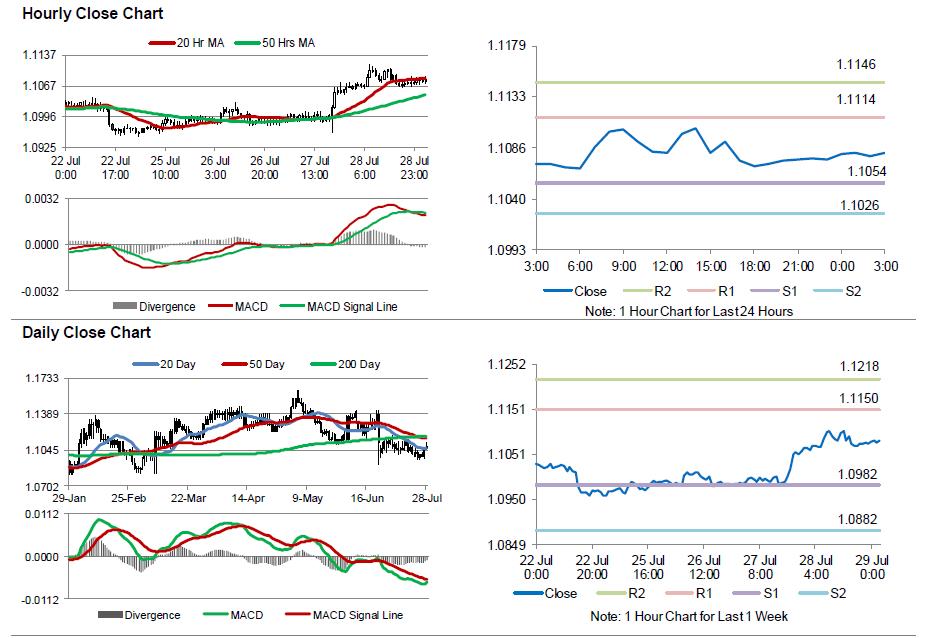

The pair is expected to find support at 1.1054, and a fall through could take it to the next support level of 1.1026. The pair is expected to find its first resistance at 1.1114, and a rise through could take it to the next resistance level of 1.1146.

Going ahead, investors will look forward to the crucial 2Q GDP flash data from the Eurozone as well as the US, due later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.