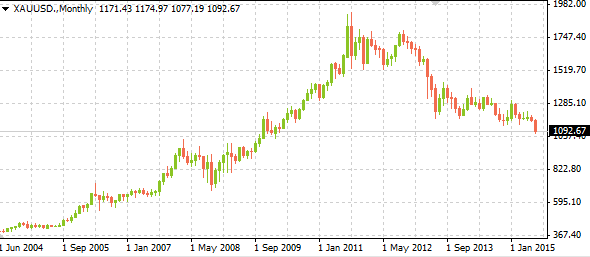

In the wake of the last financial crisis, conviction was strong that the extraordinarily loose monetary policies proposed by global central banks would send inflationary measures soaring as rapid expansion of the monetary base fomented hyperinflation. Much to the chagrin of famed economists and other well established fund managers championing higher gold prices, the commodity super cycle in general looks to have run its course. The asset class at large is in a correctionary phase that some have likened to a deflationary spiral as weak or no inflation coupled with increased confidence in Central Banks forces precious metals lower. The current situation in gold hearkens back to the summer of crude in 2008 when prices soared over $145 per barrel before proceeding to fall into the low $30s, testament to the fact that prices do not move just in one direction. At the point in time when crude was closer to its record highs, savvy investors would make projections of $200 to $300 per barrel oil, stating that oil would “never” retreat below $100 per barrel. Fast forward 7-years and a similar situation has taken hold of gold prices.

One of the first rudimentary lessons every investor should take to heart is that the word “never” has no place in trading or investing. Anything is possible and anything can happen. Traders that incorporate this lesson are destined to make better decisions over the long run. Many of the same savvy investors that were forced to backtrack after calls in the oil market backfired were of similar mindset when applying analysis to gold bullion prices. Now that recent moves in precious metals have brought the shiny metals back into the spotlight, it seems as though the smart money called the top of the market when the perception and forward looking analysis projected sky high prices and no return to normal. Now that prices are once again tumbling, it is not unreasonable to believe that gold prices have much further to fall. If they manage to take out critical support at $1050 per troy ounce, there is no reason that prices cannot cross below the $1000 threshold, pushing towards the next key long-term level at $950. The key takeaway however is that when it comes to investing is that anything is possible.

The moral of story? Forget the word “never” when it comes to trading, it can only cause investing pain and misery.