Gold prices settled higher on Monday for the fourth session in a row as the dollar extended losses. The XAU/USD pair initially fell during yesterday's Asian session but found enough to bounce and test the resistance at the $1189 level. The U.S. dollar has been on the back foot since the Federal Reserve downgraded its views on the economy and inflation last week, bolstering speculations that the central bank could delay raising rates until the fourth quarter.

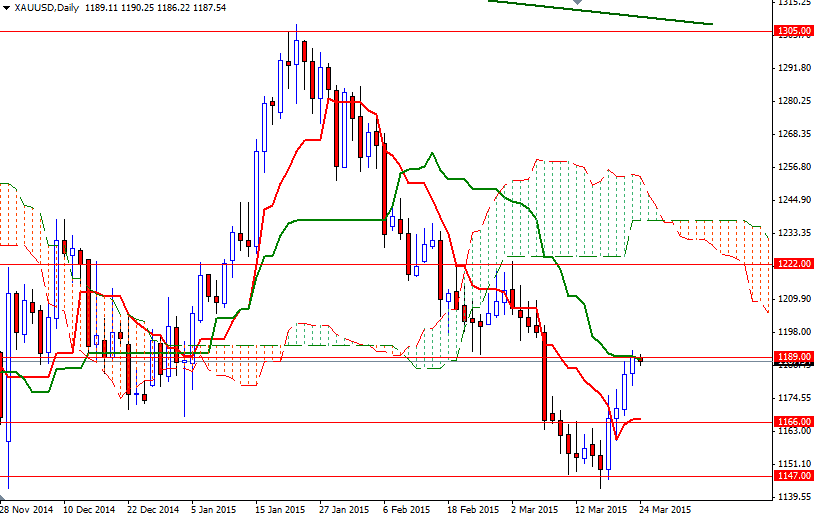

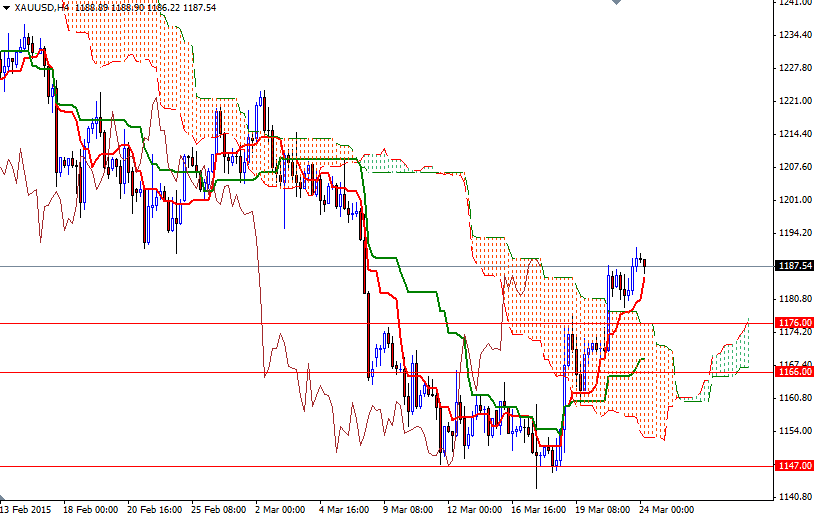

Currently the XAU/USD pair is trading between the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) on the daily chart. As I pointed out last week, a diminished likelihood of a midyear rate increase could push prices higher in the near term. From an intra-day perspective, the key levels to watch will be 1189 (1191.50) and 1179.

The XAU/USD pair had faced a good amount of downward pressure around the same levels in the past and because of that I think the market needs to climb above yesterday's high in order to gain more momentum and approach the 1199 - 1205 region. If prices successfully break through, then there is a possibility that we could visit the 1212/1 resistance. However, the inability to pass through 1191.50 might trigger some bearish pressure. Initial support is located at 1185. If the bulls run out of steam, it is likely that the XAU/USD pair will retreat towards the 1179/6 zone. Closing this level would open up the risk of a move towards the 1168/6 area.