On May 16th, when gold was trading near $1225, we published “Gold Prices Facing Fibonacci Resistance?”, saying that “the yellow metal could lose another 100 dollars of its value. Or even more.” The chart below shows how the Elliott Wave Principle helped us come to this conclusion.

As visible, we were expecting the price of gold to go a little higher, near the 61.8% Fibonacci area, and then reverse to the downside. If you are among the many who follow this market, you know exactly what happened after that. The next chart shows how the situation has been developing during the last two months.

Today, gold fell below the $1100 mark and touched $1087.70. In other words, it lost more than $144, since the top on May 18th. By breaking below $1100, the yellow metal fulfilled our long-term forecast, published more than a year ago – on July 3rd, 2014. The next chart shows how gold looked back then.

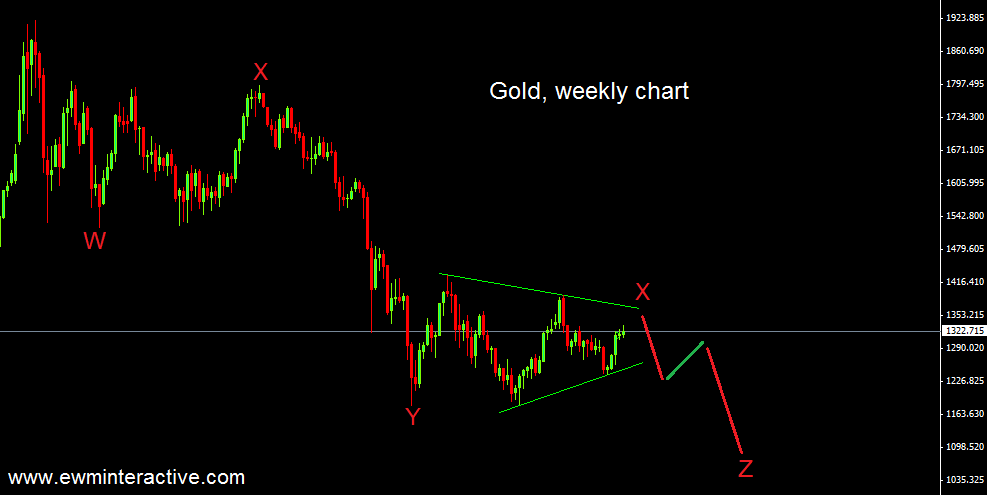

As shown, we were preparing for a post-triangle thrust to $1100, while gold was trading at $1322. As the chart below will demonstrate, this is a good example of the Wave principle’s ability to make accurate long-term forecasts, without taking any news and events into consideration. An updated chart is given below.

Triangles precede the last wave of the larger sequence. On the weekly chart of gold, the last wave is supposed to be wave Z, which is still in progress. If this count is correct, we should expect a major bullish reversal once wave Z is over. The long-term outlook is slowly turning from negative to positive.