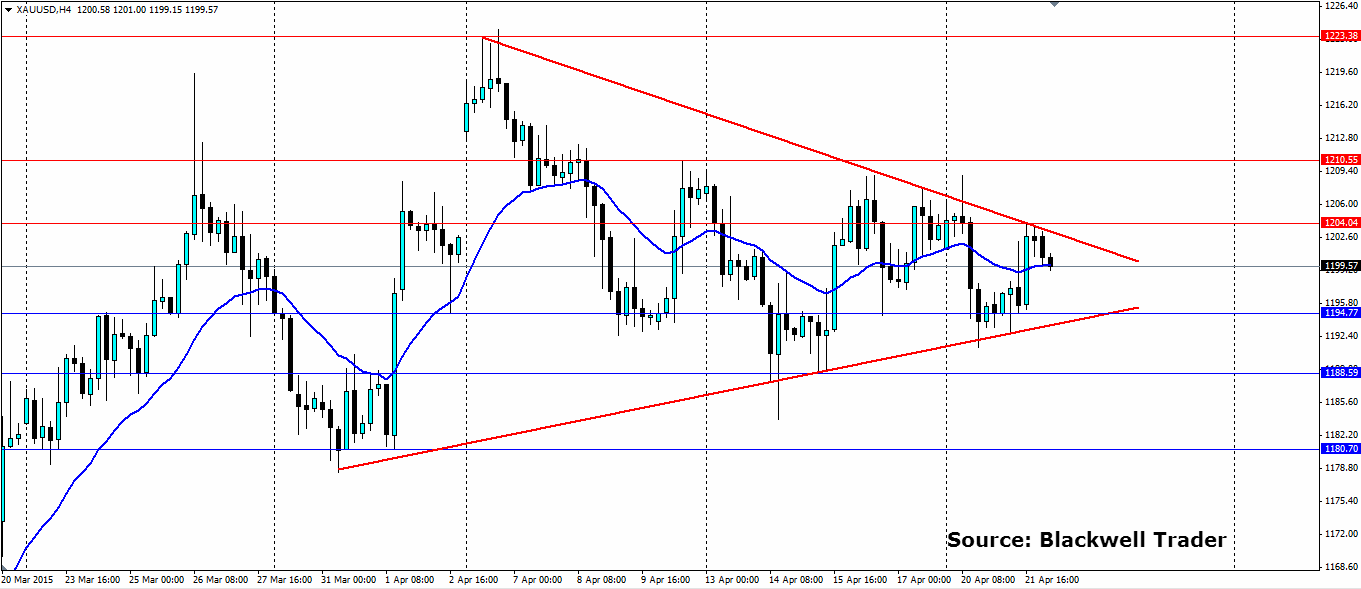

Gold has been consolidating into a large pennant structure over the past few weeks as indecision and uncertainty take hold. Once the pressure is released there will likely be a sharp movement and it could be in either direction.

The tug-o-war between factors in the gold market is causing the consolidation. One of the main drivers is the uncertainty in US Interest rates, specifically when the Fed will begin raising interest rates. The minutes of the last meeting showed the committee members split 50/50 on whether rates should rise in June or not. The Fed is keen to normalise interest rates as soon as possible and may look towards the robustness of the economy, rather than inflation, in deciding if a rise in June is appropriate.

Greece is another big factor for the gold market at the moment. Greece could default on their loans in as little as two months which would send turmoil through the European markets and plenty of investors rushing to gold. There are suggestions a ‘haircut’ of up to 90% on the bailout loans could be imposed if Greece were to enter a “disorderly default”. Either way this situation is going to dominate headlines in the coming months and gold will react accordingly.

China is having its effect on the gold markets too as the PBOC recently cut the reserve requirement ratio (RRR) that banks must hold by 100bp to 18.5%. The slowdown in china is providing demand for gold and the extra stimulus will certainly provide further support.

All of this has seen gold consolidate into a pennant shape as the bulls and the bears fight over the scraps of news. As we get into the pointy end of the shape we are likely to see a large movement if and when a breakout occurs. Watch for support at 1194.77, 1188.59 and 1180.70 while resistance will be found at 1204.04, 1210.55 and 1223.38. At this stage it could be in either direction given the fundamental uncertainty in the market, so it could pay to set yourself up to take advantage of the momentum in either direction.