The XAU/USD pair (Gold vs. the American dollar) fell 1% on Tuesday, extending its losses to a second straight session, and touched the lowest level since June 19.

Although the pair initially traded as high as $1313.67 an ounce, prices broke below the 1306 support level and hit 1292.04 after Federal Reserve Chair Janet Yellen commented on the outlook for interest rates. Yellen said “If the labor market continues to improve more quickly than anticipated by the Federal Open Market Committee, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned” in her testimony to the Senate Banking Committee.

It seems like, despite the drop in the unemployment rate, the FOMC still has some hesitations because recent gains haven't been enough to lead into wage pressure. However, at some point, the Fed will (be forced to) start to raise interest rates to normalize policy. This is something to pay attention as strength in the American dollar tends to weaken the appeal of commodities such as gold.

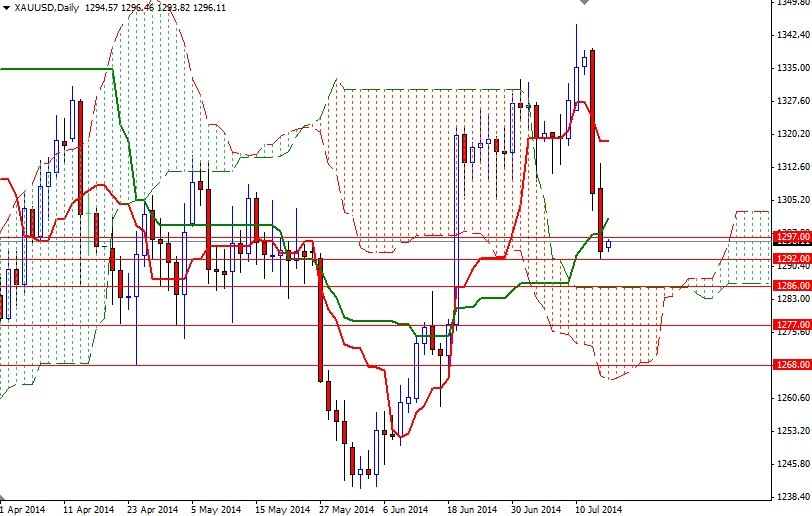

From a technical perspective, I think the key levels to watch will be 1292 and 1297/8.50. If the bulls manage to hold the market above the 1292 level which happens to be the Kijun-Sen line (twenty six-day moving average, green line) on the daily time frame and climb above 1298.50, they might find a chance to revisit the 1302/6 area. Beyond that, the bears will be waiting at 1312. On the other hand, if the market breach yesterday's low, it is likely that we will see the pair testing the next support level at 1286 where the Ichimoku cloud resides. Closing below support would suggest that the bears will be aiming for 1277 next.