Gold advanced for the first time in five sessions as easing concerns about the timing of future interest rate hikes lured some investors back into the market. Comments from Federal Reserve Chairwoman Janet Yellen who testified before the House Financial Services Committee yesterday reinforced the view that the Federal Reserve might be willing to wait -until policy makers are confident that inflation will move up over time- before raising rates.

While some market players think that the subdued outlook for global economic growth will maintain a constant downward pressure on the precious metal, some people remain bullish based on skepticism about the sustainability of the stock market rally. Although I don't see a compelling case for gold (over the long term), I will stick to the charts as usual.

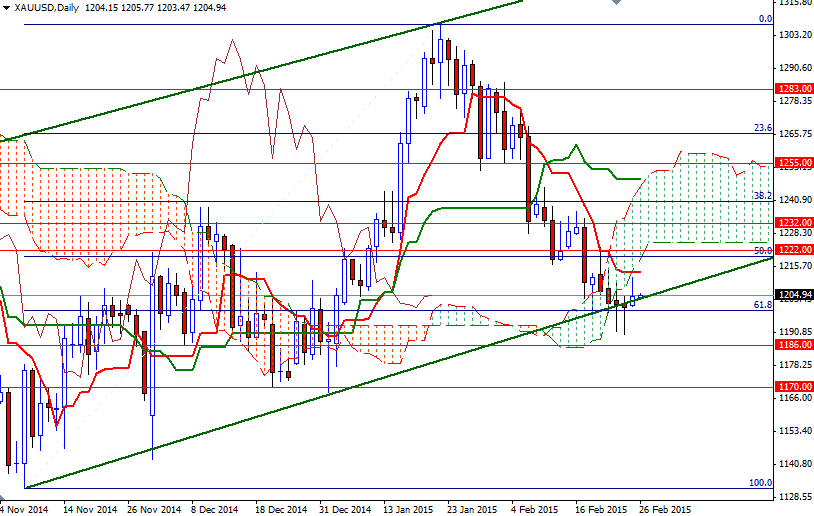

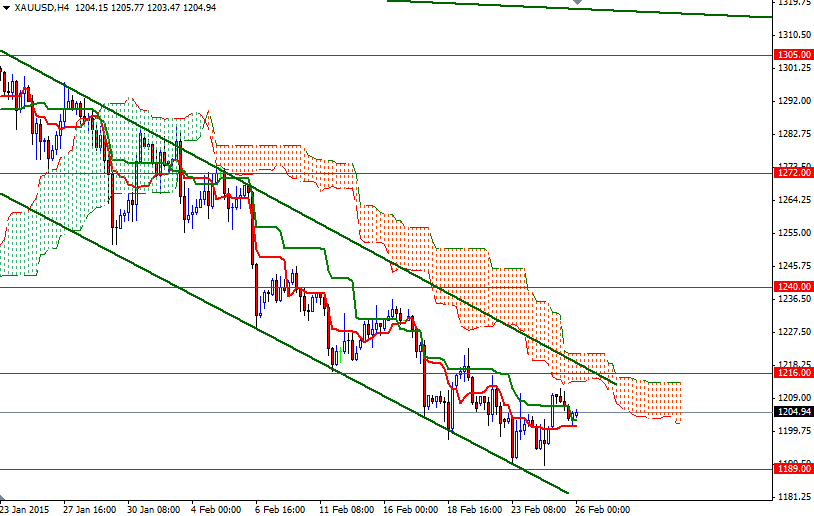

Trading below the Ichimoku clouds on the weekly, daily and 4-hour charts suggest that the broader directional bias remains weighted to the downside. However, the market seems to be reluctant to break below the 1189/6 area at the moment (plus the XAU/USD pair haven't closed under the 1199/7 region where 61.8% Fibonacci retracement level reside). This makes me think that we may see a bullish attempt in the near-term, if the bulls manage to hold the pair above 1199/7. The market has to push its way through the 1225/2 resistance zone in order to gain some momentum. But before that, the bulls will need to penetrate the 1213.45 - 1216 area. If the clouds on the 4-hour time frame continue to offer resistance and prices start to fall, keep an eye on the 1199/7 support. Closing below that would indicate the next stop might be the 1189/6 area.