Gold has started the week with slight losses, as the metal is trading at a spot price of $1195.95 on Monday. On the release front, today’s sole event is US Existing Home Sales, with an estimate of 5.03 million.

The Greek bailout saga continues, as Greece and its creditors try to find some common ground on a bailout extension. Greece was granted a four-month extension on Friday, provided that the country could provide a list of “reform commitments” showing that Greece would continue to reform its economy. Greece’s creditors will review the proposals on Tuesday before giving their approval to the extension. Even if this occurs, the extension is a stop-gap measure and the bailout crisis is far from over.

Key US indicators painted a mixed picture on Thursday. Unemployment Claims rebounded strongly with a sharp drop of 283 thousand, compared to 304 thousand a week earlier. This easily beat the estimate of 293 thousand. The news was not as good from the Philly Fed Manufacturing Index, which slipped to 5.2 points, down from 5.3 points and a third straight drop. The markets had expected a reading of 8.8 points.

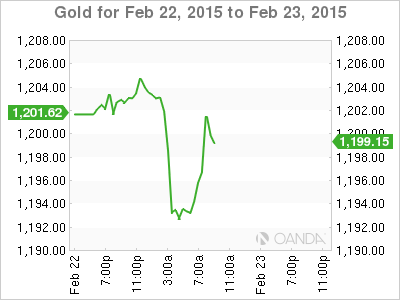

XAU/USD for Monday, February 23, 2015

XAU/USD February 23 at 12:50 GMT

- XAU/USD 1195.95 H: 1204.95 L: 1191.00

XAU/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1131 | 1154 | 1175 | 1200 | 1215 | 1240 |

- XAU/USD was flat in the Asian session. The pair dipped lower in European trade, breaking below support at 1200.

- 1200 has switched to a resistance role and is a weak line. 1215 is next.

- 1175 is an immediate support level.

- Current range: 1175 to 1200

Further levels in both directions:

- Below: 1175, 1154 and 1131 and 1111

- Above: 1200, 1215, 1240, 1255 and 1275

OANDA’s Open Positions Ratio

XAU/USD ratio is almost unchanged on Monday. This is not consistent with the pair’s movement, as gold has started the week with losses. The ratio has a majority of long positions, indicating trader bias towards gold reversing direction and moving to higher ground.

XAU/USD Fundamentals

- 15:00 US Existing Home Sales. Estimate 5.03M.

*Key releases are highlighted in bold

*All release times are GMT