Gold ended the week down 2.17% as strength in the dollar and equities markets eroded the appeal of the precious metal as an alternative investment. The market initially rose during Friday's session, at one point traded as high as $1215.34 an ounce, but investors abandoned gold and flocked to stocks after U.S. manufacturing data beat forecasts and Eurozone finance ministers reached an agreement to extend Greece's financial rescue programme. Markit's flash manufacturing purchasing managers’ index came in at 54.3, up from the previous month's 53.9 and above expectations for a reading of 53.7. Equity markets around the globe surged to record highs as Athens had pledged to honor all its debts and agreed to present an initial list of reform measures by Monday.

This week sees a slew of U.S. reports, with the highlight preliminary gross domestic product data on Friday. On Tuesday, Fed Chair Janet Yellen gives semiannual testimony on the economy and monetary policy before the Senate Banking Committee. The minutes of the Federal Open Market Committee meeting held on Jan. 27-28 showed that officials worried about lower-than-expected inflation and slow wage growth as well as international developments. However, some officials think that rates may have already been kept low "for a sufficient length of time, and that it might be appropriate to begin policy firming in the near term". While equity markets continue going up and the currency market maintains positive view for the greenback, gold's upside potential may be limited. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 131734 contracts, from 155274 a week earlier.

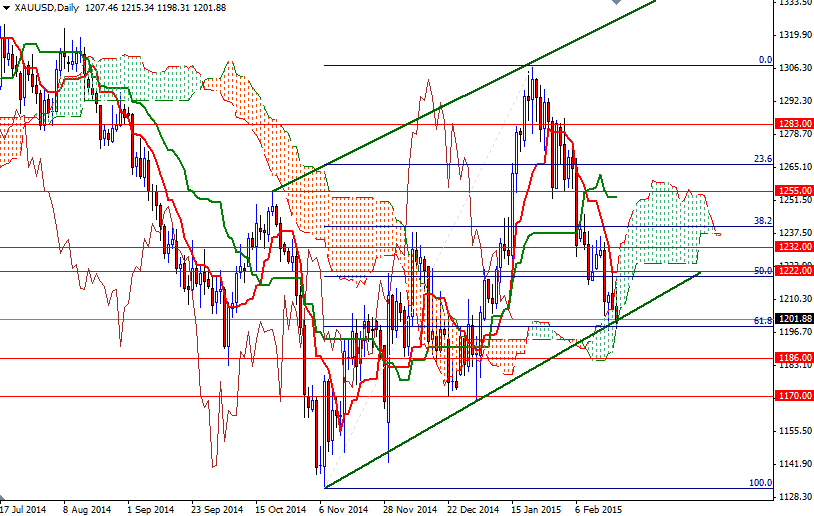

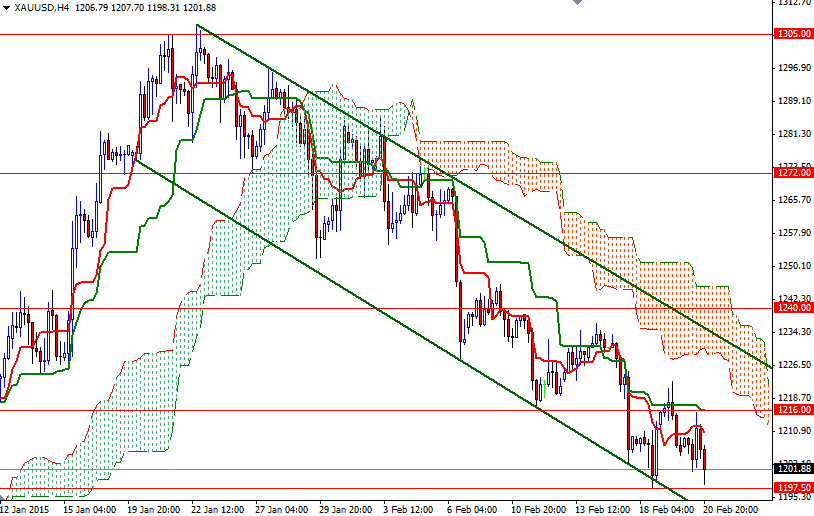

From a technical point of view, I think there are two things to pay close attention. First of all, the XAU/USD pair is trading below the Ichimoku clouds on the weekly and 4-hour time frames. This picture which indicates that higher prices will continue to attract sellers in the medium-term will remain gloomy while the Chikou-span (closing price plotted 26 periods behind, brown line) stays below prices. On the other hand, the XAU/USD pair is sitting on a short-term ascending trend-line and moving inside the daily cloud. Initial support is located at 1197.50 - 1195. If the bears are able to maintain control and shatter the support at 1189/6, then it is likely that the market will test 1170/66 and 1159 next. To the upside, the first hurdle is located at 1216. If the bulls capture this point, I think they will have a chance to tackle the resistance at 1223/2. In order to gain enough momentum and challenge the 1255 level, the bulls have to break through 1240.