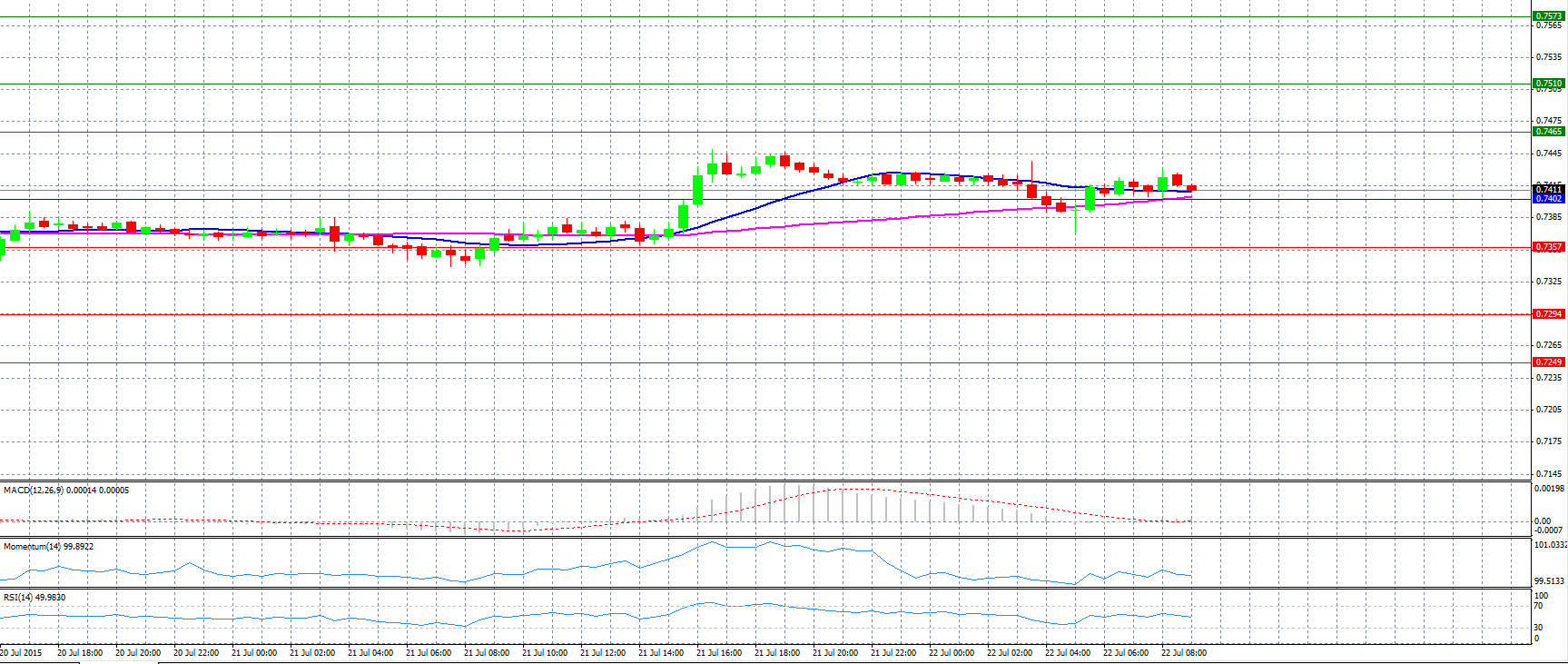

Market Scenario 1: Long positions above 0.7402 with targets @ 0.7465 & 0.7510.

Market Scenario 2: Short positions below 0.7402 with targets @ 0.7357 & 0.7294.

Comment: The pair trades calm slightly above pivot point 0.7402.

Supports and Resistances:

R3 0.7573

R2 0.7510

R1 0.7465

PP 0.7402

S1 0.7357

S2 0.7294

S3 0.7249

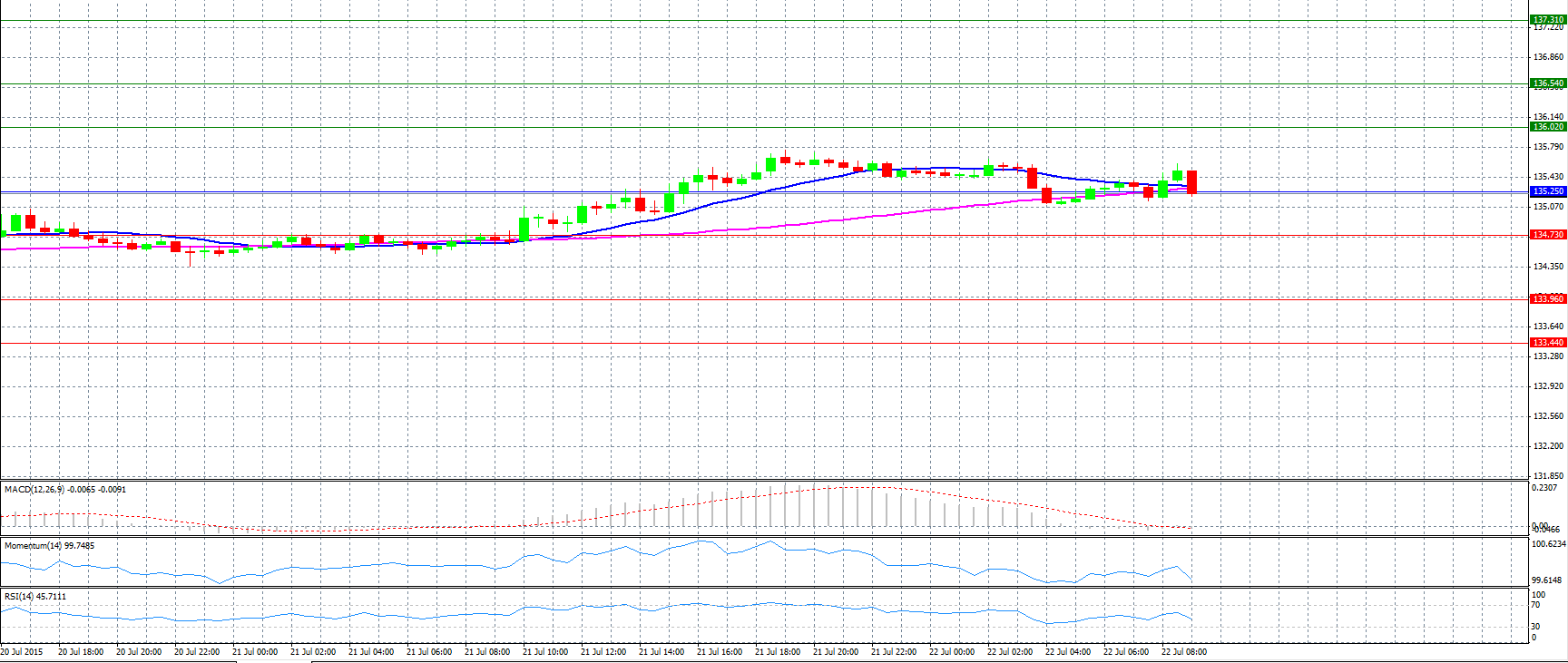

Market Scenario 1: Long positions above 135.25 with targets @ 136.02 & 136.54.

Market Scenario 2: Short positions below 135.25 with targets @ 134.73 & 133.96.

Comment: The pair tests to break below support at pivot point 135.25

Supports and Resistances:

R3 137.31

R2 136.54

R1 136.02

PP 135.25

S1 134.73

S2 133.96

S3 133.44

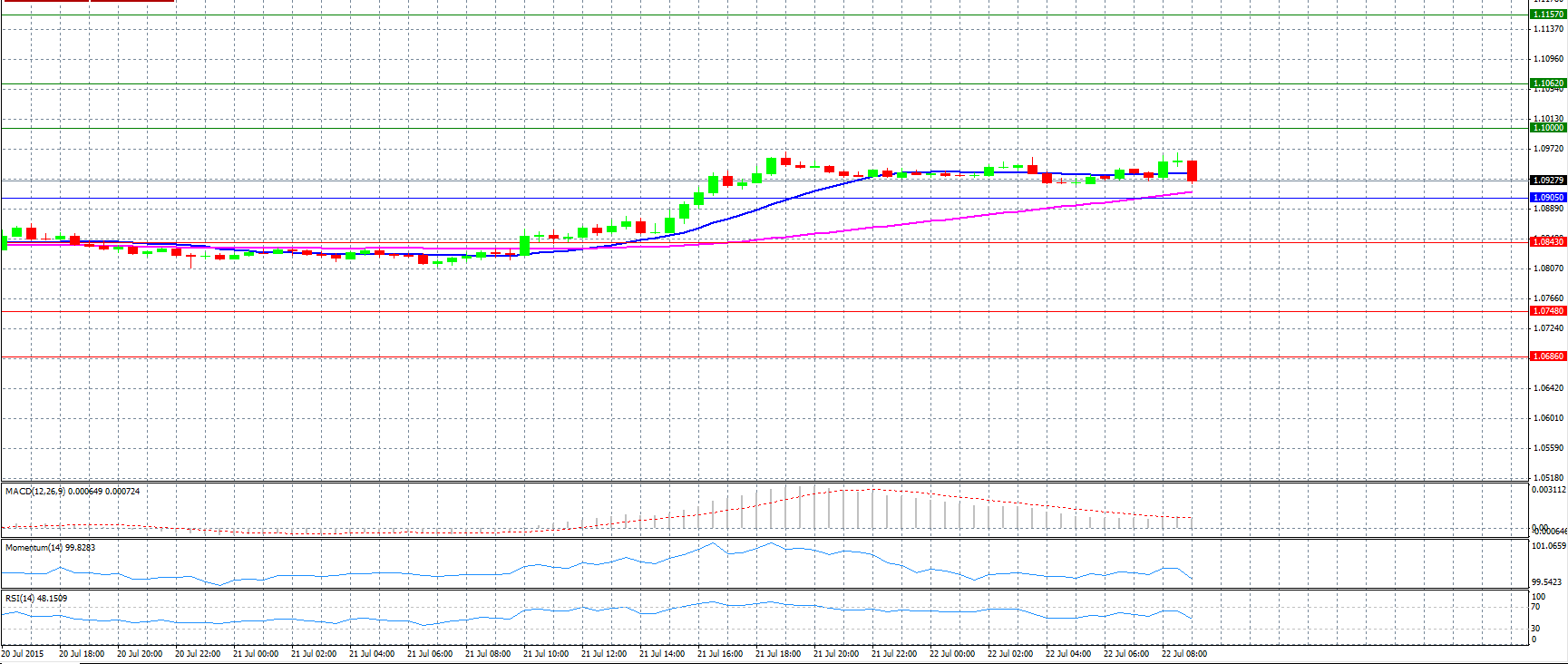

Market Scenario 1: Long positions above 1.0905 with targets @ 1.1000 & 1.1062.

Market Scenario 2: Short positions below 1.0905 with targets @ 1.0843 & 1.0748.

Comment: The pair is now shedding initial gains and went back to the 1.0930 area.

Supports and Resistances:

R3 1.1157

R2 1.1062

R1 1.1000

PP 1.0905

S1 1.0843

S2 1.0748

S3 1.0686

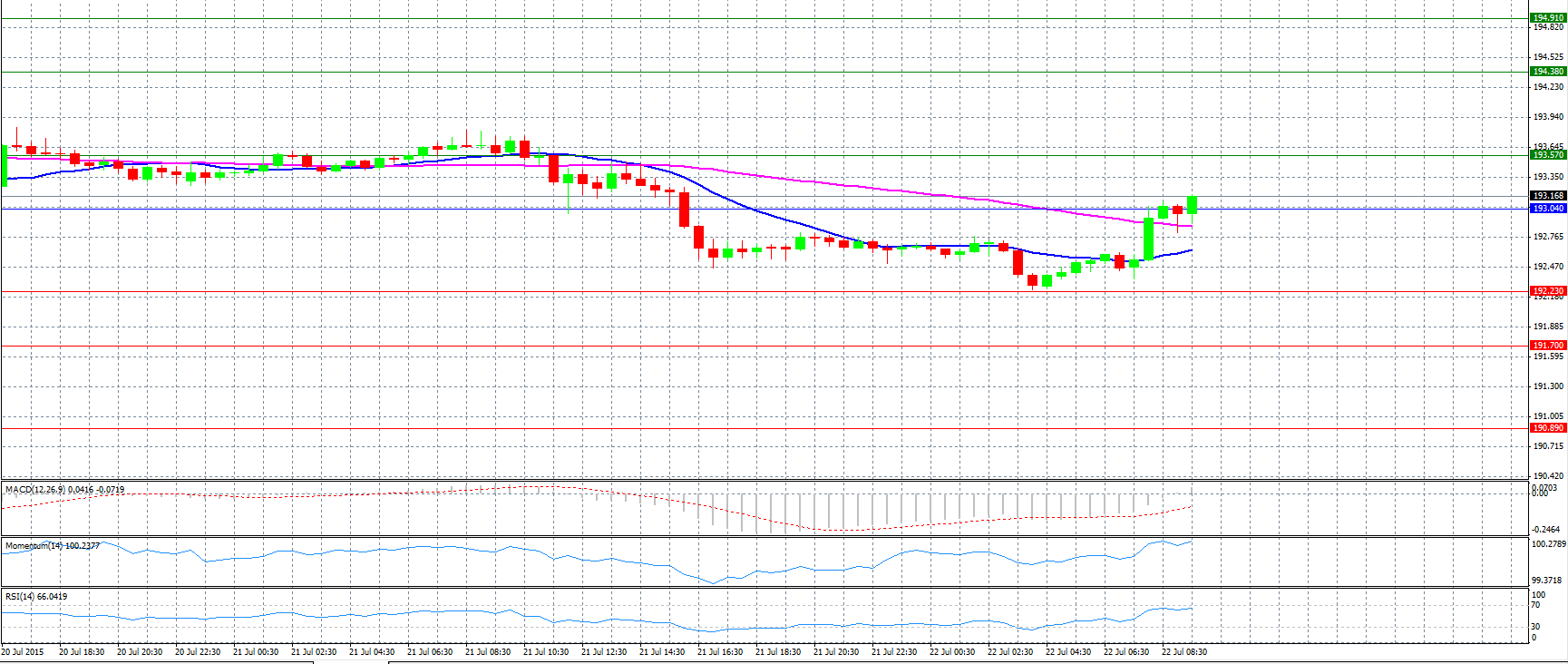

Market Scenario 1: Long positions above 193.04 with targets @ 193.57 & 194.38.

Market Scenario 2: Short positions below 193.04 with targets @ 192.23 & 191.70.

Comment: The pair advanced and managed to break pivot point level 193.04.

Supports and Resistances:

R3 194.91

R2 194.38

R1 193.57

PP 193.04

S1 192.23

S2 191.70

S3 190.89

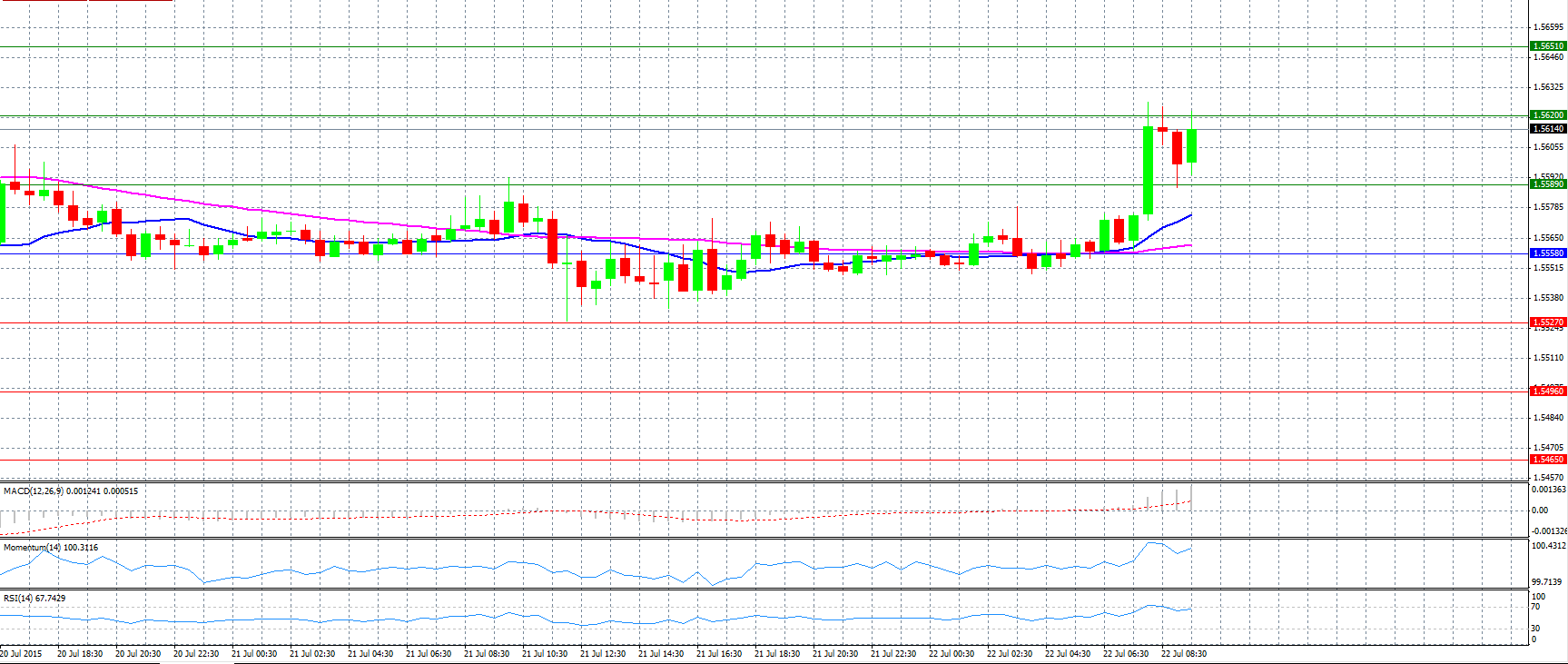

Market Scenario 1: Long positions above 1.5558 with targets @ 1.5589 & 1.5620.

Market Scenario 2: Short positions below 1.5558 with targets @ 1.5527 & 1.5496.

Comment: The pair rose and tests the second resistance level at 1.5620.

Supports and Resistances:

R3 1.5651

R2 1.5620

R1 1.5589

PP 1.5558

S1 1.5527

S2 1.5496

S3 1.5465

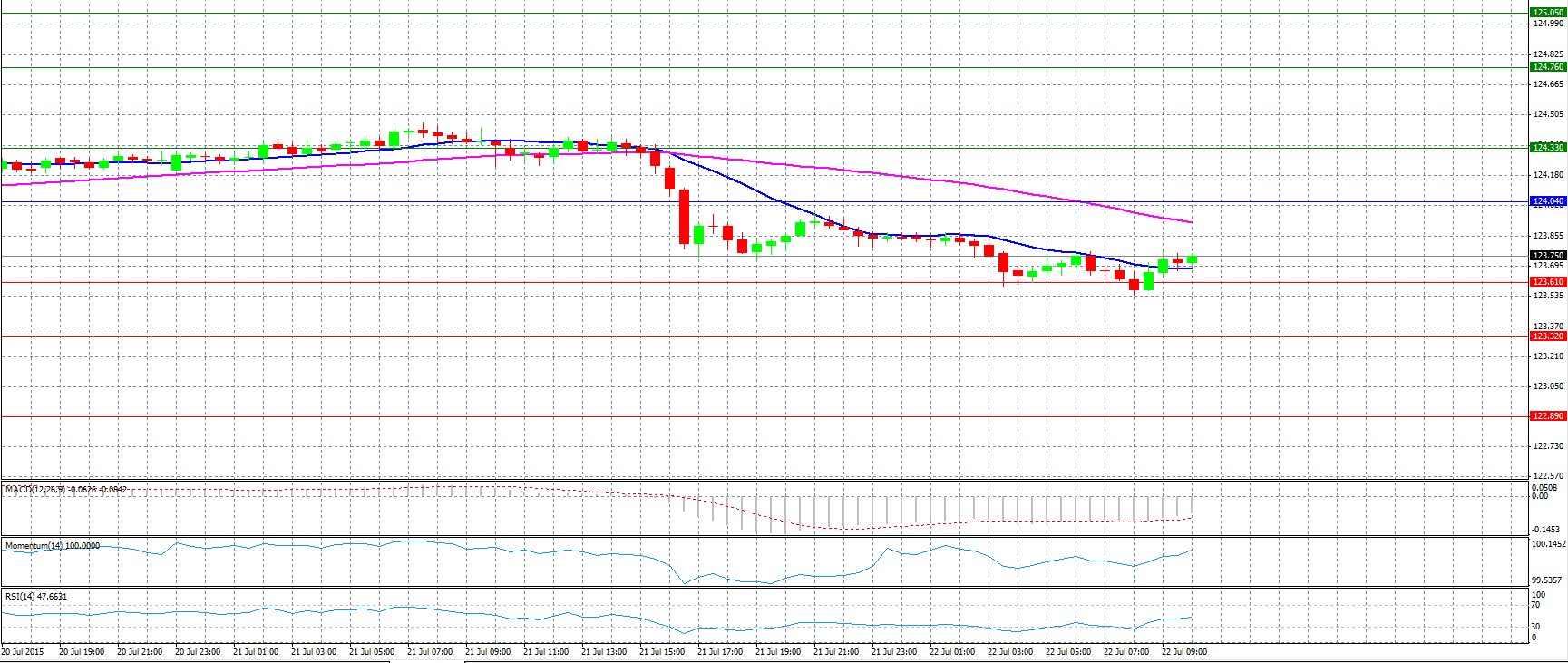

Market Scenario 1: Long positions above 124.04 with targets @ 124.33 & 124.76.

Market Scenario 2: Short positions below 124.04 with targets @ 123.61 & 123.32.

Comment: The pair is expected to navigate within 123.00 and 124.50 according to analysts.

Supports and Resistances:

R3 125.05

R2 124.76

R1 124.33

PP 124.04

S1 123.61

S2 123.32

S3 122.89

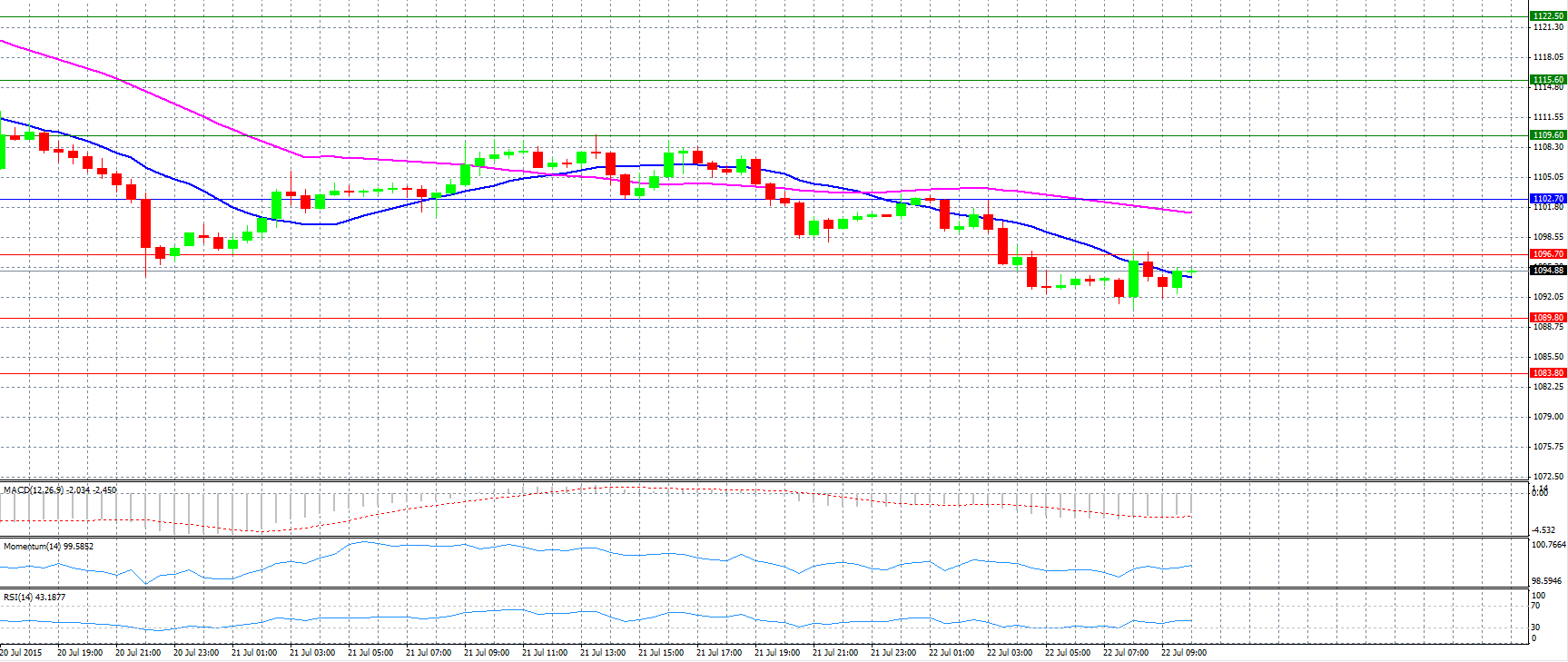

Market Scenario 1: Long positions above 1102.70 with targets @ 1109.60 & 1115.60.

Market Scenario 2: Short positions below 1102.70 with targets @ 1096.70 & 1089.80.

Comment: Gold prices weakened and continue to decline below support level 1096.70.

Supports and Resistances:

R3 1122.50

R2 1115.60

R1 1109.60

PP 1102.70

S1 1096.70

S2 1089.80

S3 1083.80

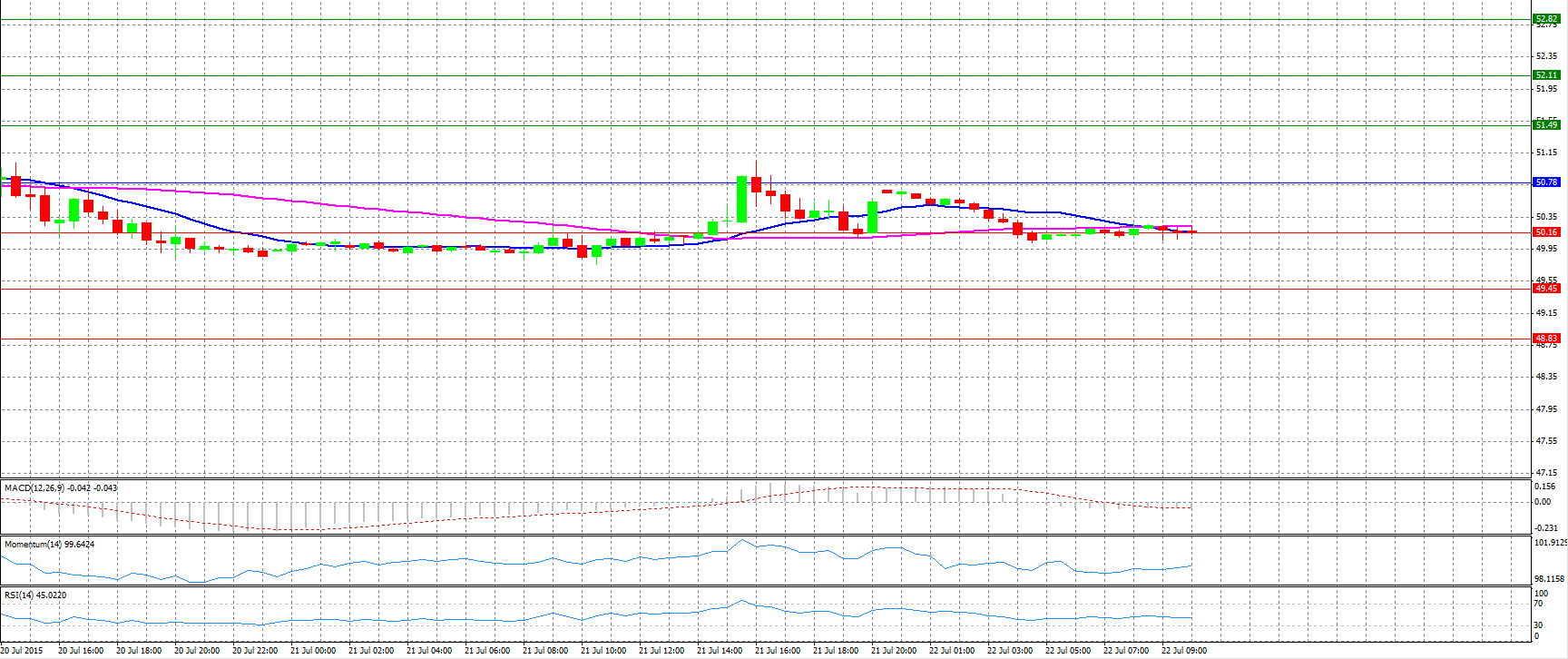

CRUDE OIL

Market Scenario 1: Long positions above 50.78 with targets @ 51.49 & 52.11.

Market Scenario 2: Short positions below 50.78 with targets @ 50.16 & 49.45.

Comment: Crude oil prices trade neutral near support level 50.16 level.

Supports and Resistances:

R3 52.82

R2 52.11

R1 51.49

PP 50.78

S1 50.16

S2 49.45

S3 48.83

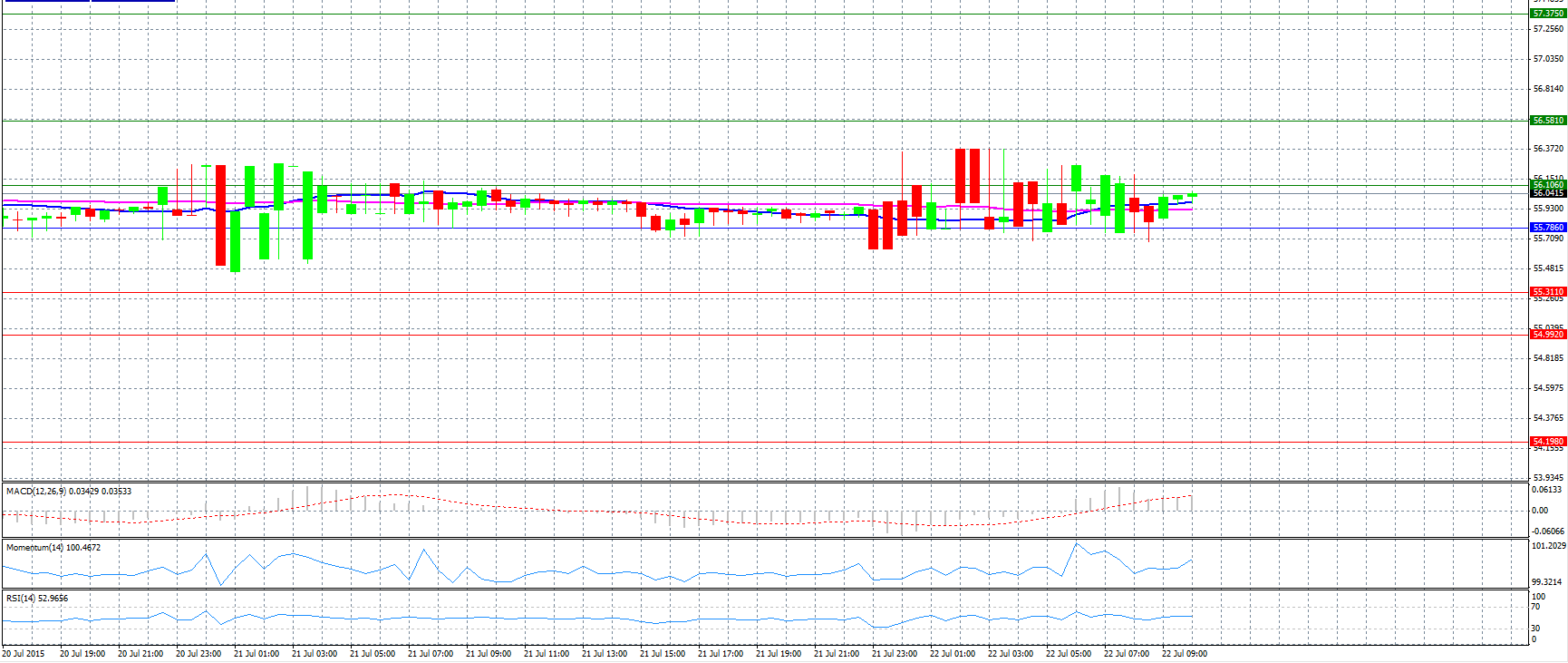

Market Scenario 1: Long positions above 55.786 with targets @ 56.106 & 56.581.

Market Scenario 2: Short positions below 55.786 with targets @ 55.311 & 54.992.

Comment: The pair trades mostly in the area between pivot point 55.786 and resistance level 56.106.

Supports and Resistances:

R3 57.375

R2 56.581

R1 56.106

PP 55.786

S1 55.311

S2 54.992

S3 54.198