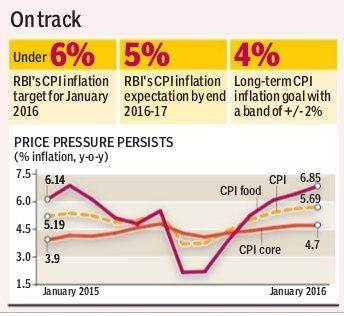

Retail inflation rose to a 17-month high of 5.69% in January on dearer food items, rising for the sixth month, though it remained safely within the Reserve Bank Of India’s target of under 6% for the month, official data showed on Friday. Given improved consumption levels in the economy — GDP growth in the third quarter was driven chiefly by urban consumption — potential inflationary risks stayed, analysts said, wary of predicting if the central bank would cut rates in April.

This despite separate data showed industrial output shrank for a second month, to -1.3% in December versus a revised -3.4% in November when the Index of Industrial Production fell for the first time since October 2014.

Among the upside risks to inflation are the uncertainties about the monsoon in 2016, the likely pay hike of up to 24% for central government staff and a resultant uptick in household purchasing power, and a potential pick-up in global commodity prices — especially crude oil — from multi-year lows.

The central bank could therefore face some challenges in containing retail inflation within its expected level of 5% by the end of the 2016-17 fiscal, said analysts. As such, some economists have asked the government to enhance capital spending until the private sector gets back on its feet to boost the economy and dump its self-imposed fiscal deficit target of 3.9% for 2015-16 and 3.5% for the next fiscal. If the government accepts the challenge, the consequent fiscal slippage may also add to underlying inflationary pressure at the retail levels.

Conceding some of the challenges that may arise from such a situation, RBI governor Raghuram Rajan, while reviewing the monetary policy earlier this month, said: “The implementation of the VII Central Pay Commission award, which has not been factored into these projections, will impart upward momentum to this (inflation) trajectory for a period of one to two years. The RBI will adjust the forecast path as and when more clarity emerges on the timing of implementation.”

However, he added that under the assumption of a normal monsoon and the current level of international crude oil prices and exchange rates, inflation is expected to be inertial and be around 5% by the end of fiscal 2016-17. It’s another matter that some analysts have criticised the RBI’s sole focus on targeting CPI inflation at the cost of ignoring other variables of growth, apart from predicting possible friction between the central bank and the government on fiscal discipline.

CPI inflation, which remained sticky around 9-10% during 2012-2014, moderated to 5.9% in the last fiscal and further to 4.9% in the April-January period, with analysts predicting it could average 5% in the current fiscal.

It is reckoned by some that the expectations of improved purchasing power might have prompted the Central Statistics Organisation to project a close to 12% growth in private final consumption expenditure for the last quarter of this fiscal, although both the economists and even CSO officials reckon that the projection could be revised downward later. The 40-basis-point rise in food inflation in January to 6.85% on top of an almost 40-basis-point increase in December, thanks to the stubbornly high inflation in pulses (43.3% for January), suggests that inflationary pressure from such items in the coming months will not evaporate. Although crude oil prices are ruling around 12-year lows, any uptick from here will raise both the Wholesale Price Index and the CPI.

“On a year-on-year basis, higher prices of wheat, pulses and edible oil, plus sticky prices of health, education, housing services, combined with a higher service tax rate have been keeping CPI inflation elevated,” said Rupa Rege Nitsure, chief economist at L&T Finance Holdings.

Manufacturing contracted by 2.4% in December, following up on a 4.7% drop in the previous month. Interestingly, the growth in manufacturing output in the IIP was recorded at just 0.9%, in stark contrast to an impressive 12.6% jump in the gross value added (GVA) data recorded for the December quarter. However, policymakers point to the difference between the IIP being a gauge for output and the GVA for value addition. The current IIP, with 2004-05 base year, may not accurately capture industrial activity well, analysts argue, and until the revised series comes into effect, the contrast between the two sets of data will be more dramatic.

Importantly, the output of capital goods, a gauge for fixed corporate investment, contracted 19.7% in December, having already shrunk 24.5% in November. Consumer goods production rose only 2.8% in December, aided by a 16.5% expansion in durables output, which was, however, helped by a favourable base. While consumer durables witnessed a 16.5% jump in December, aided by the low base (it had contracted 9.2% a year before), non-durables output dropped 3.2% in December. This suggests private demand is yet to see a sustained recovery, thanks to the rural distress following a second straight year of deficient monsoon and a crash in global commodity prices.