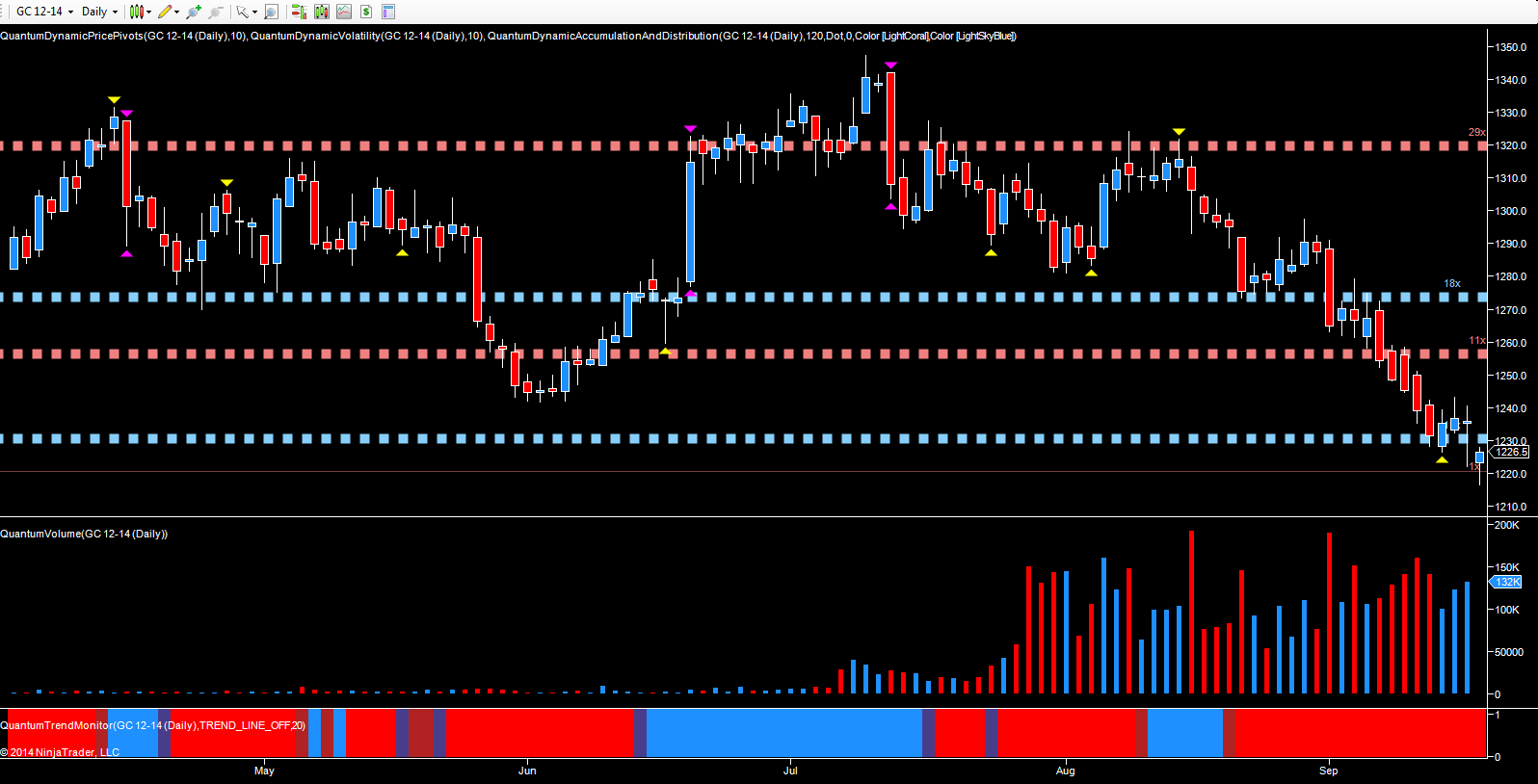

These are torrid and turbulent times for Gold, and for anyone thinking the worst was over, the overnight session has delivered yet another hammer blow, with the December gold futures contract opening gapped down at $1223.1 and shedding $12.80 per ounce from the close of 1235.90 last night. This heavily bearish sentiment has continued in trading this morning, with the contract moving lower still and inexorably towards the $1200 per ounce region and below. Gold really does appear to have lost its shine as investors continue to buy risk.The gap down overnight was also significant for another reason, as the price action jumped over the potential support platform in the $123o per ounce region, and with this now taken out of play, there are few regions of support below. The next logical level is now $1195 per ounce and should this fail then $1184 is the next target, taking out the low of February at $1185 per ounce. The volume profiles on the daily chart merely confirm this very bearish picture, with last week’s falling market coupled with steadily rising volumes as the market moved beyond 150k on Thursday. This week’s recovery has been equally bearish, with Wednesday’s up candle closing with a narrow body and deep upper wick, clearly signaling weakness, duly confirmed overnight. With the CRB index once again moving lower in today’s trading session, and trading at 282.16 down 0.68% on the day, the outlook for commodities in general, and gold in particular remains bearish. The US dollar, too, is adding it’s own weight to the current landscape and with the dollar index looking to move beyond 85 in the short term, this too is helping to push commodities lower. Even the buying season in India seems unable to provide any assistance.

Only When This Happens

For gold bugs, it’s a gloomy picture and the only chink of light is the news that the super rich are investing in solid gold 12.5Kg bars, sales of which have increased by 243% so far this year whilst sales of the 1 .0 Kg bar have tripled when compared with the same period last year. The super rich can only do so much and until the big operators move in to buy the market and a consequent buying climax, it will continue to fall.