The Junior Gold Miners (ARCA:GDXJ) ETF is bouncing off support at the 20 day moving average showing some bullish support and accumulation. Gold is holding the $1300 area showing a major January bounce which may forecast a powerful 2015. As the old saying on the market teaches, “As January goes, so goes the year.”

The US stock market is showing increasing volatility on lower optimism for good earnings growth. Gold is continuing to gain momentum as the 20 and 50 day moving averages turn positive. A golden crossover of the 50 and 200 day could be only a week or two away. It has been a rough four years for junior mining investors as the Venture hits 2008 and 2002 lows. However, there could be a good chance from both a technical and fundamental standpoint that the correction cycle in precious metals is coming to a conclusion.

The green light is on for precious metals and the junior gold and silver miners. The yellow lights is on for oil and base metals and the red warning sign is on the overbought US equity and bond market. Gold is finally breaking out in terms of US dollars. The US dollar has seen a major boost in value over the past six months due to other currencies crashing, however that could change soon for the dollar as the Fed may have to keep up with the global debasement race.

Demand may continue to grow for physical gold and silver especially from China, India and Russia. There is no doubt that the global economy is in a contraction or deflation. Interest rates are negative as Central Banks all over the world try to print their way out of this mess. It doesn’t seem that the QE is working. However, you can be sure the Central Banks will do all they can to throw paper money at the problem.

The big banks are finally realizing that the US Fed may not be so quick to raise rates in 2015. Investors may wake up when the Fed institutes more QE to keep up in this global currency war. Eventually, investors should want precious metals. Gold stock trade readers are already positioned for the scenario which is currently being played out. By now my readers should own a considerable amount of physical gold and silver bullion as well as high quality junior miners on the verge of major growth. If gold steadies around $1300 a lot of junior miners are going to breakout.

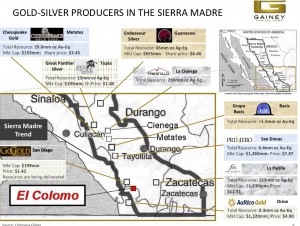

For instance two weeks ago, I highlighted Gainey Capital (GNC.V or GNYPF) as an interesting cash flow opportunity in the junior mining sector as it owns an interesting property and a mill in the heart of the Sierra Madre Gold/Silver Trend. Unlike many juniors it has cash and near term cash flow. Recently, Gainey announced a 10k ton per day processing agreement with Belmex Resources. I hope to hear more deals announced in the coming weeks as Gainey owns the only gravimetric/flotation processing plant in the area which is designed to increase recovery rates. Its also operated by an experienced milling supervisor George Cantua who supervised Barrick’s 24k ton per day mill in the Dominican Republic.

Investors should look where Gainey’s mill is located in relation to some of the other gold-silver deposits nearby. As gold and silver comes back into favor, miners may look to process increasing amounts of their ore with Gainey. I hope to hear positive developments with more processing agreements and the beginning of exploration on El Colomo.

Disclaimer: I own Gainey Capital and they are a current website sponsor. Please do your own due diligence and be aware of any conflicts of interest. I would benefit if the stock goes higher.