The October US consumer price index is out at the bottom of the hour and is the main risk event today.

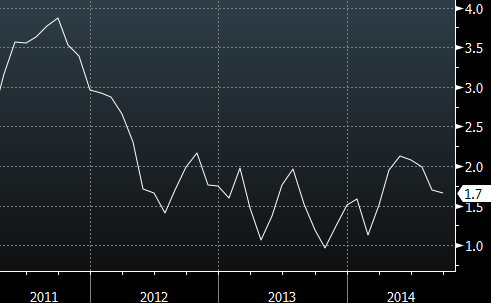

Expectations are for a 1.6% y/y rise in total inflation and a 1.7% y/y rise excluding food and energy. The risks are balanced and there will likely be straight-forward buy or sell kneejerk on higher or lower numbers, respectively. Even a one tick miss will be enough to spark a move.

The trade I like is buying a US dollar dip on a soft reading. I envision something similar to yesterday’s FOMC minutes. They were dovish and the US dollar slid lower but after about 15 minutes it turned around.

US CPI y/y