For centuries, gold has been a go-to asset among investors worried about all sorts of financial risks. In the past decade, exchange-traded funds backed by the metal drew more money than any other commodity. Even the world’s biggest central banks hoard bullion as a reserve asset.

But when it comes to inflation, which can erode the value of portfolios that don’t keep pace with rising consumer prices, anyone who bought gold as a hedge over the past 25 years missed out on a much better deal — copper. While data show that broad commodity indexes provided the best bang for the buck during periods of rising costs in the U.S., the red metal stands out.

For every 1 percent annual increase in the consumer price index since 1992, copper jumped almost 18 percent, more than three times the 5.2 percent gain logged by gold, according to a correlation analysis of total return commodity indexes compiled by Bloomberg. Only a broader index of energy commodities, which includes oil and natural gas, performed better than copper.

Copper is “more sensitive to inflation and the dollar because of its uses and its growth with the economy,” Jodie Gunzberg, global head of commodities and real assets at S&P Dow Jones Indices, said in an interview June 15. “Investors are more comfortable with gold. When you run the numbers, gold has relatively low sensitivity to inflation.”

Measuring that sensitivity is something called “inflation beta.” The correlation of any one commodity to rising consumer prices can be volatile. For example, copper fell in 2011 even as inflation accelerated. But over time, there are patterns to the relationship that make holding raw materials a good bet when inflation is accelerating, said Mike McGlone, analyst at Bloomberg Intelligence in New York.

“The traditional reason to hold commodities is for inflation,” because as the economy heats up, consumption increases for everything from cars and homes to appliances and travel, McGlone said in a June 19 phone interview.

Analysts have dubbed copper “the metal with a Ph.D. in economics” because it’s been a reliable bellwether. When construction and manufacturing are growing, so do sales of wire and pipe. While inflation has been relatively tame since the financial crisis almost a decade ago, there are signs it may start to accelerate again.

Federal Reserve Chair Janet Yellen this month pledged more interest rate increases in 2017 to keep the economy from overheating. On Tuesday in London, she reaffirmed her commitment to “price stability” and a 2 percent inflation target.

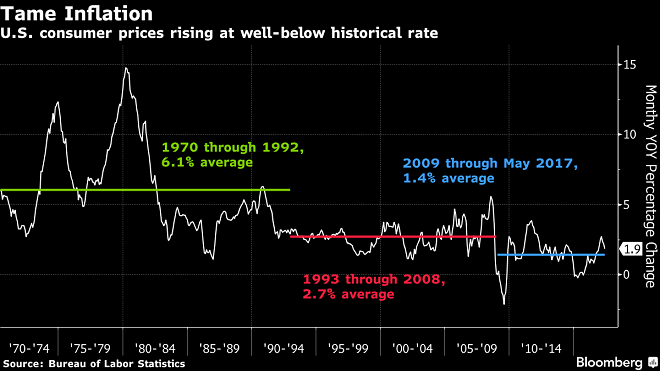

The Fed and other central banks have held interest rates near zero for a record period to stimulate growth, which has taken years to gain traction. Even with signs of a pickup in the U.S. economy, inflation remains below historical rates.

From 1970 to 1992, the monthly year-over-year gain in the consumer price index averaged 6.1 percent, reaching a high of 14.8 percent in March 1980, government data show. Since the financial crisis in 2008, prices rose on average just 1.4 percent, including some periods of deflation in 2009 and 2015.

“Inflation is a little bit lower than what we would like, but we think if the labor market continues to tighten, wages will gradually pick up,” Fed Bank of New York President William Dudley said June 19. “And with that, we’ll see inflation get back to 2 percent.”

Last year, copper jumped 18 percent, while spot gold rose just 8 percent. So far in 2017, bullion is the better gainer, up 9.1 percent, while copper on the London Metal Exchange rose 5.5 percent. But there are signs of improvement ahead for the industrial metal.

Prices had plunged early in 2016 to a six-year low as China’s economy slowed and production rose. But mining companies have cut output and demand is growing again. Barclays Plc estimated in a June 26 report that global demand will exceed mine output this year by 56,000 metric tons, and widen to 72,000 tons in 2018. In 2016, there was a surplus of 102,000 tons, the bank estimates.

Gold’s appeal

Still, gold has been the preferred metal to use for hedging. While investors can buy physical metal or futures and options, among the most popular method is holding exchange-traded funds that trade like stocks. The SPDR Gold Trust Holdings, the largest ETF backed by bullion, has about $34.5 billion invested in the precious metal. The ETFS Copper fund has $270 million, and other funds linked to the metal tend to be small and illiquid.

Not everyone is convinced inflation is going to take off, especially with low prices for energy, perhaps the biggest commodity influence on consumer costs. Oil futures are mired in a bear market after plunging from more than $100 a barrel in 2014 to less than $45 this week. The yield curve for Treasuries also has flattened, suggesting inflation poses little risk to interest-bearing securities in the near future.

“Up to this point, I think that we can still expect that inflation will go up to 2 percent, although I will say that the most recent inflation data make me a little nervous about that, so I think it’s much more challenging from here on out,” Charles Evans, the president off the Federal Reserve Bank of Chicago, said June 20.