The silver market can be rather confusing for a lot of traders, but there is hope that it’s not too hard to understand as it bounces around on technical patterns on the chart.

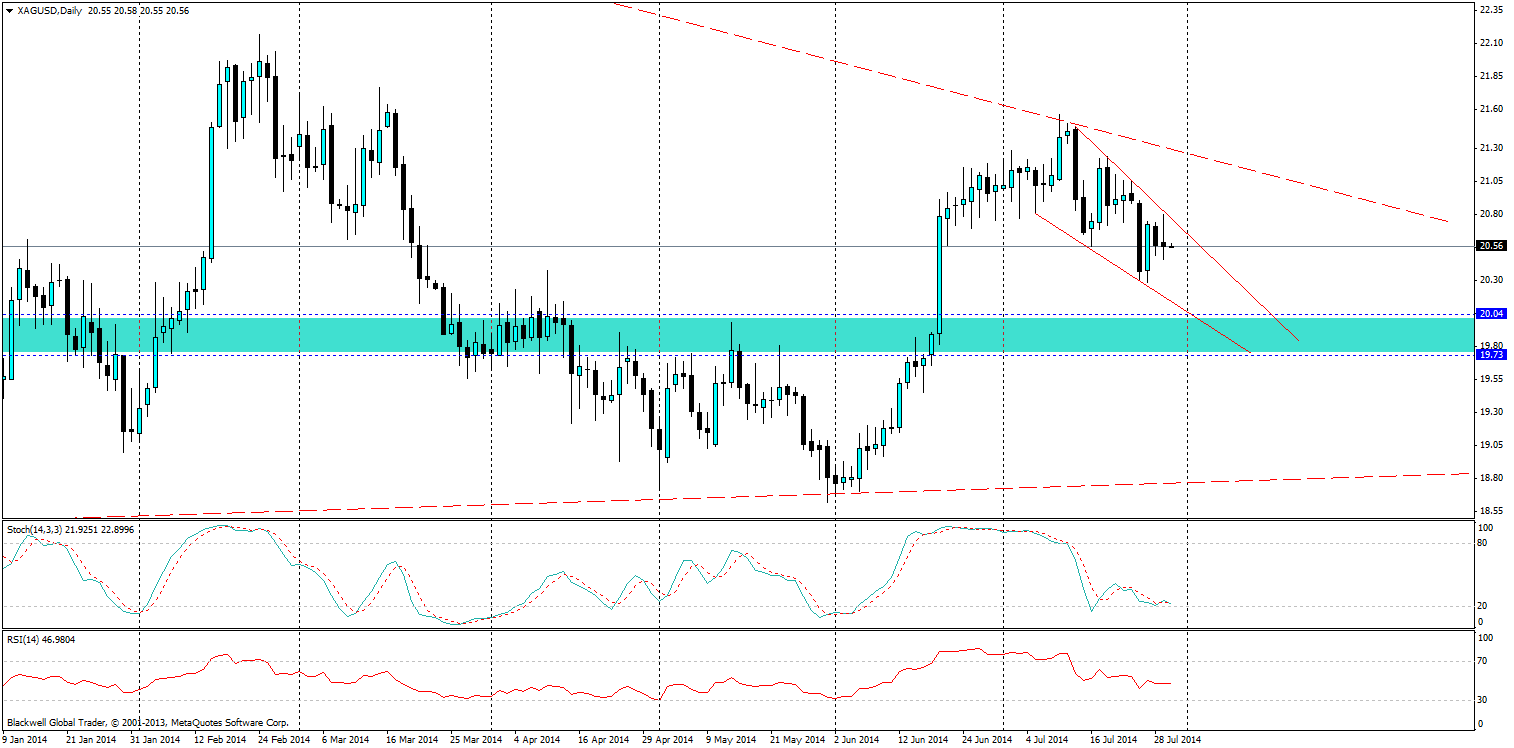

After a strong touch on the bearish trend line silver has looked to range back downwards in a descending wedge, and that’s not surprising given that markets are starting to look up at the U.S dollar. All forecasts this week are expected to show positive results for the U.S economy, whether that is actually true remains to be seen. But, it’s a positive sign when forecasters are looking forward with some optimism.

So with a descending wedge, it generally means that we will see a bullish breakout higher at some point. Currently the market is at 20.57 and further lows look very much possible. I am targeting the 20.04-19.73 area which has shown in the past to be a turning point with high volume and liquidity in the market. Traders will be looking to target this area as well.

Movements lower though could struggle if U.S. data is weaker than expected, however, the current trend line will likely trap movements higher in the event of weaker U.S. data.

Overall, bearish sentiment remains in the short term until we get below the present 20.00 dollar an ounce mark, and strong U.S. data will help extend this push lower. A strong non-farm reading might even push it completely into the range we are targeting and in turn help provide a breakout of the present descending wedge.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.