USD/JPY is unchanged in the Wednesday session, as the pair trades just above the 104 line. In economic news, the Japanese Services Producer Price Index gained 0.3%, edging above the estimate of 0.2%. In the US, today’s highlight is New Home Sales. The indicator is expected to drop to 601 thousand. On Thursday, the US will release Core Durable Goods Orders and Unemployment Claims.

The Bank of Japan will be in the spotlight next week, as the central bank holds a policy meeting on October 31. The BoJ has consistently sent out messages to the markets that it is willing to adopt further easing if needed. However, it’s questionable if the bank is willing to back up its words with action, as it has stayed on the sidelines for most of 2016 despite a weak economy and deflation concerns.

With the Abe government approving a large stimulus program in August, the BoJ may have taken a back seat in the battle to coax inflation and growth to higher levels. If the bank doesn’t adopt any easing measures at the next policy meeting, the yen could recover some of its recent losses to the greenback.

Market sentiment over a Fed rate hike continues to rise. The CME Fed Watch has priced in a December rate hike at 72%. The prospect of a US rate hike for the first time in over a year has bolstered the US dollar against its rivals, including the Japanese yen.

The US economy remains strong, buoyed by a labor market that is close to capacity, with unemployment at a healthy 5.0%. Inflation levels remain low and are unlikely to show much improvement in the next few months. Although the Fed would prefer stronger inflation levels, other economic indicators remain strong enough such that the lack of inflation is unlikely to be the critical factor in the Fed rate decision. The Fed will also hold a policy meeting in early November, but it’s unlikely to make any rate moves just before the US presidential election.

USD/JPY Fundamentals

Tuesday (October 25)

- 19:50 Japanese SPPI. Estimate 0.2%. Actual 0.3%

Wednesday (October 26)

- 8:30 US Goods Trade Balance. Estimate -60.6B

- 8:30 US Preliminary Wholesale Inventories. Estimate 0.1%

- 9:45 US Flash Services PMI. Estimate 52.4

- 10:00 US New Home Sales. Estimate 601K

- 10:30 US Crude Oil Inventories. Estimate 0.7M

Upcoming Key Events

Thursday (October 27)

- 8:30 US Core Durable Goods Orders. Estimate 0.2%

- 8:30 US Unemployment Claims. Estimate 261K

- 19:30 Japanese Household Spending. Estimate -2.6%

- 19:30 Tokyo Core CPI. Estimate -0.5%

*All release times are EDT

*Key events are in bold

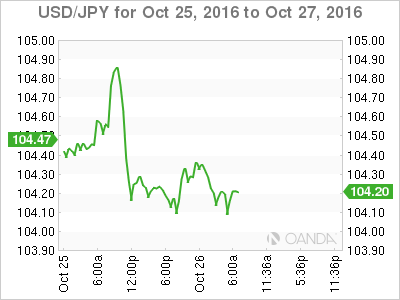

USD/JPY for Wednesday, October 26, 2016

USD/JPY October 26 at 6:15 EDT

Open: 104.16 High: 104.39 Low: 104.00 Close: 104.18

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 101.20 | 102.36 | 103.02 | 104.32 | 105.44 | 106.72 |

- USD/JPY posted slight gains in the Asian session but has retracted in the European session

- 103.02 is providing strong support

- 104.32 remains a weak resistance line

- Current range: 103.02 to 104.32

Further levels in both directions:

- Below: 103.02, 102.36 and 101.20

- Above: 104.32, 105.44, 106.72 and 107.49

OANDA’s Open Positions Ratio

USD/JPY ratio is unchanged on Wednesday, consistent with the lack of movement from USD/JPY. Currently, long positions have a majority (55%), indicative of slight trader bias towards USD/JPY breaking out and moving higher.