World Energy to 2050: A Half Century of Decline

Posted by Stoneleigh on November 10, 2007 - 10:30am in The Oil Drum: Canada

This is Part 1 of a guest post by GliderGuider. Paul's website can be found here.

This article supercedes an earlier work, "World Energy and Population: Trends to 2100". Compared to that paper this article offers a more comprehensive look at the world's evolving energy picture and confines its projections to the first half of the century. Also unlike that earlier work, this article makes no assumptions about changes in human population due directly to reductions in the world's energy supply. At the end of the article I will briefly examine one highly probable effect the decline in total energy would have on the quality of human life.

Introduction

Throughout history, the expansion of human civilization has been supported by a steady growth in our use of high-quality exosomatic energy. This growth has been driven by our increasing population and our increasing level of activity. As we learned to harness the energy sources around us we progressed from horse-drawn plows, hand forges and wood fires to our present level of mechanization with its wide variety of high-density energy sources. As industrialization has progressed around the world, the amount of energy each one of us uses has also increased, with the global average per capita consumption of all forms of energy rising by 50% in the last 40 years alone.

This rosy vision of continuous growth has recently been challenged by the theory of "Peak Oil", which concludes that the amount of oil and natural gas being extracted from the earth will shortly start an irreversible decline. As that decline progresses we will have to depend increasingly on other energy sources to power our civilization. In this article I will offer a glimpse into that changed energy future. I hope to be able to provide a realistic assessment of the evolution of the global energy supply picture, and to estimate how much of the various types of energy we will have available to us in the coming decades.

Methodology

The analysis in this article is supported by a model of trends in energy production. The model is based on historical data of actual energy production, connected to projections drawn from the thinking of various expert energy analysts as well as my own interpretation of future directions and some purely mathematical projections.

The current global energy mix consists of oil (36%), natural gas (24%), coal (28%), nuclear (6%), hydro (6%) and renewable energy such as biomass, wind and solar (about 2%). Historical production in each category (except for renewable energy) has been taken from the BP Statistical Review of World Energy 2007. In order to permit comparison between categories I use a standard measure called the tonne of oil equivalent (toe). Using this measure, well-known conversion factors for thermal and electrical energy production permit the different energy sources to be easily compared.

We will first examine the energy sources separately, applying the development parameters that seem most appropriate to each. For each source I will define as clearly as possible the factors I have considered in building its scenario. This transparency will allow you to decide for yourself whether my assumptions seem plausible. We will then combine the individual energy analyses into a single global energy projection.

Notes

The model was developed as a simple Excel spreadsheet. The timing of some significant energy-related events and rates of increase or decrease of supply were chosen through careful study of the available literature. In some cases different authors had diverging opinions on these matters. To resolve those situations I have relied on my own analysis and judgment. As a result the model has remained open to the influence of my personal biases. I make no apology for this potential subjectivity; such scenarios always reflect the opinions of their authors, and it is best to be clear about that from the start. Nevertheless, I have made deliberate efforts throughout to be objective in my choices, to base my projections on observed trends in the present and recent past, and to refrain from wishful thinking at all times.

This article will not present any prescriptive measures. The analysis is intended solely to clarify a "most likely" future scenario, based purely on the situation as it now exists and will probably unfold. You will not find any specific suggestions for what we ought to do, or any proposals based on the assumption that we can radically alter the behaviour of people or institutions over the short term. While the probability of such changes will increase if the global situation shifts dramatically, such considerations would introduce a level of uncertainty into the analysis that would make it conceptually intractable. The same constraint holds true for new technologies. You will not find any discussion of fusion or hydrogen power, for example.

The Excel spreadsheet containing the data used in this model is available here.

Our Energy Sources

Oil

The analysis of our oil supply starts from the recognition that it is finite, non-renewable, and subject to effects which will result in a declining production rate in the near future. This situation is popularly known as Peak Oil. The key concept of Peak Oil is that after we have extracted about half the total amount of oil in place the rate of extraction will reach a peak and then begin an irreversible decline.

This peak and decline happens both for individual oil fields and for larger regions like countries, but for different reasons. In individual oil fields the phenomenon is caused by geological factors inherent to the structure of the oil reservoir. At the national or global level it is caused by logistical factors. When we start producing oil from a region, we usually find and develop the biggest, most accessible oil fields first. As they go into decline and we try to replace the lost production, the available new fields tend to be smaller with lower production rates that don't compensate for the decline of the large fields they are replacing.

Oil fields follow a size distribution consisting of a very few large fields and a great many smaller ones. This distribution is illustrated by the fact that 60% of the world's oil supply is extracted from only 1% of the world's active oil fields. As one of these very large fields plays out it can require the development of hundreds of small fields to replace its production.

The theory behind Peak Oil is widely available on the Internet, and some introductory references are given here, here and here. In addition, the German organization Energy Watch Group provides an exceptionally comprehensive (but still accessible) overview of the topic in the Executive Summary of their recently released study of Peak Oil.

Timing

There is much debate over when we should expect global oil production to peak and what the subsequent rate of decline might be. While the rate of decline is still hotly contested, the timing of the peak has become less controversial. Recently a number of very well informed people have declared that the peak has arrived. This brave band includes such people as billionaire investor T.

Boone Pickens, energy investment banker Matthew Simmons (author of the book "Twilight in the Desert" that deconstructs the state of the Saudi Arabian oil reserves), retired geologist Ken Deffeyes (a colleague of Peak Oil legend M. King Hubbert) and Dr. Samsam Bakhtiari (a former senior scientist with the National Iranian Oil Company). This view is also supported by the extremely detailed analysis published by the Energy Watch Group mentioned above.

My position is in agreement with these luminaries: the peak is happening as I write these words (in late 2007). I have confirmed its occurrence to my own satisfaction by examining the pattern of oil production and oil prices over the last three years. I discovered in the process that crude oil production peaked in May 2005 and has shown no growth since then despite a doubling in price and a dramatic surge in exploration activity.

Decline Rate

The post-peak decline rate is another question. The best guides we have are the performances of oil fields and countries that are known to be already in decline. Unfortunately, those decline rates vary all over the map. The United States, for instance, has been in decline since 1970 and has lost 40% of its production capacity since then, for a decline rate of about 2% per year. On the other hand, the North Sea basin is showing an annual decline around 10%, and the giant Cantarell field in Mexico is losing production at rates approaching 20% per year.

In order to create a realistic decline model for the world's oil, I have chosen to follow the approach of the Energy Watch Group, which is similar in profile to the projections of Dr. Bakhtiari in

his WOCAP model. Both assume a gradually increasing decline rate over time, starting off very gently and ramping up as the years go by. The main difference is that the EWG model is slightly less aggressive than WOCAP. WOCAP predicts that production will fall from its current value of 4000 million tonnes of oil per year (Mtoe/yr) to 2750 Mtoe/yr in 2020, while the EWG projects a decline to 2900 Mtoe/yr by then. The EWG projects an oil supply of just under 2000 Mtoe in 2030. My model projects a decline rate increasing from 1% per year in 2010 to a constant rate of 5% per year after 2025, resulting in an average decline rate of 4% per year between now and 2050. In 2050 oil production is only 18% of what it is today, as shown in Figure 1.

Figure 1: Global Oil Production, 1965 to 2050

Keep in mind that Peak Oil is primarily a transportation fuel problem. Almost 70% of the world's oil is used in transportation as gasoline, diesel fuel, jet fuel and bunker fuel for ships. Right now there is a lot of excitement surrounding the development of electric cars. However, the immediacy of the peak and the slope of the following decline suggest that it may prove difficult to replace enough of the global automobile fleet in the time available to maintain the ubiquitous personal mobility we have become used to. Europe and Asia are placing a lot of emphasis on electrifying inter-city rail and urban mass transit. Rail electrification seems like a sensible initiative that should be pursued urgently by all nations.

Natural Gas

The supply situation with natural gas is very similar to that of oil. This similarity makes sense because oil and gas come from the same biological source and tend to be found in similar geological formations. Gas and oil wells are drilled using very similar equipment. The differences between oil and gas have everything to do with the fact that oil is a viscous liquid while natural gas is, well, a gas.

While oil and gas will both exhibit production peaks, the slope of the post-peak decline for gas will be significantly steeper due to its lower viscosity. To help understand why, imagine two identical balloons, one filled with water and the other with air. If you set them down and let go of their necks, the air-filled balloon will empty much faster than the one filled with water. Even though oil and gas reservoirs are made up of porous rock rather than being big pockets of liquid or gas, they behave in much the same way. Because of its viscosity, oil reservoirs often require their internal pressure to be raised over time by pumping in water, in order to force out the oil and maintain their flow rates. In contrast, when a gas reservoir is pierced by the well, the gas flows out rapidly under its own pressure. As the reservoir empties the flow can be kept relatively constant until the gas is gone, when the flow will suddenly stop.

Gas reservoirs show the same size distribution as oil reservoirs. As with oil, we found and drilled the big ones, in the most accessible locations, first. The reservoirs that are coming on-line now are getting progressively smaller, requiring a larger number of wells to be drilled to recover the same volume of gas. For example, the number of gas wells drilled in Canada between 1998 and 2004 went up by 400% (from 4,000 wells in 1998 to 16,000 wells in 2004), while the annual production stayed constant. These considerations mean that the natural gas supply will exhibit a similar bell-shaped curve to what we saw for oil. In fact, the production of natural gas peaked in the United States in 2001, and in Canada in 2002. In addition, the remaining large gas and oil deposits are in less and less accessible locations, making the extraction of their reserves slower and more expensive.

One other difference between oil and gas is the nature of their global export markets. Compared to oil, the gas market is quite small due to the difficulty in transporting gases compared to liquids. While oil can be simply pumped into tankers and back out again, natural gas must first be liquefied (which takes substantial energy), transported in special tankers at low temperature and high pressure, then re-gasified at the destination which requires yet more energy. As a result most of the world's natural gas is shipped by pipeline, which pretty well limits gas to national and continental markets. This constraint has an important implication: if a continent's gas supply runs low it is very difficult to supplement it with gas from somewhere else that is still well-supplied.

The peak of world gas production may not occur until 2025, but two things are sure: we will have even less warning than we had for Peak Oil, and the subsequent decline rates may be shockingly high. I have chosen 2025 as the global peak (20 years after Peak Oil). The peak is followed by a rapid increase in decline to 10% per year by 2050, for an average decline rate of 6% per year. In 2050 gas production is projected to be only 24% of its current value. The production curve for natural gas is shown in Figure 2.

Figure 2: Global Natural Gas Production, 1965 to 2050

One of the big concerns regarding a decrease in global natural gas supplies has to be about its role in the production of ammonia for fertilizer. Currently 4% of the world's natural gas is used for fertilizer production (the largest uses are as industrial and residential heat sources, and for electricity generation). As the gas supply declines the price will automatically rise and fertilizer prices will go along for the ride. Rising fertilizer prices will have dire consequences in a world whose expanding population needs to be fed, where much of the land would not be able to sustain its current production levels without artificial fertilizer, and where the largest population increases will occur in the poorest nations with the least productive soils.

It is possible to produce the hydrogen required to make ammonia (the feedstock for most fertilizer) from other sources - coal and electrolysis are often mentioned. There are substantial risks associated with those approaches, though. The cost of hydrogen from alternative sources is still considerably higher than for hydrogen made from methane, pricing any resulting fertilizer out of the reach of those who need it most. Making hydrogen from coal will also generate greenhouse gases as the carbon is burned for process heat. Electrolysis depends on having cheap sources of surplus electricity available, electricity that is not being used for higher priorities. As will become clear below, there is a strong posibility that such surpluses will never materialize, especially if the natural gas currently being used for electricity generation needs to be replaced by other sources.

Oil and Gas Combined

Oil and natural gas are the world's primary fuel sources, used for both transportation and heat. Together they supply a full 60% of the energy currently used by humanity. According to this model, their combined energy peak will come in 2012, at 6679 Mtoe. By 2050 they will be producing a combined energy of only 1386 Mtoe. This represents a drop of 80%. To the extent that we cannot replace this shortfall through novel uses of electricity from other sources, this decline represents an enormous challenge. It is a challenge that seems destined to alter the fundamental shape of our civilization over the next three or four decades.

Coal

Coal is the ugly stepsister of fossil fuels. It has a terrible environmental reputation, going back to its first widespread use in Britain in the 1700s. London's coal-fired "peasoup" fogs were notorious, and damaged the health of hundreds of thousands of people. Nowadays the concern is less about soot and ash than about the acid rain, mercury and especially carbon dioxide that results from burning coal. For the same amount of energy released, coal produces more CO2 than either oil or gas. From an energy production standpoint coal has the advantage of very great abundance. Of course that very abundance is a huge negative when considered from the perspective of global warming.

Most coal today is used to generate electricity. As economies grow, so does their demand for electricity. The need to use electricity to replace some of the energy lost due to the decline of oil and natural gas will put yet more upward pressure on the demand for coal. At the moment China is installing two to three new coal-fired power plants per week, and has plans to continue at that pace for at least the next decade.

Just as we saw with oil and gas, coal will exhibit an energy peak and decline, though for different reasons. One important factor in the eventual decline of the energy obtained from burning coal is that we have in the past concentrated on finding and using the highest grade of coal: anthracite. Much of what remains consists of lower grade bituminous and lignite. These grades of coal produce less energy when burned, and require the mining of ever more coal to get the same amount of energy.

In addition to their exemplary study of oil supplies mentioned above, the Energy Watch Group has also conducted an extensive analysis of coal use over the next century. I have adopted their "best case" conclusions for this model. The model projects a continued rise in the use of coal to a peak in 2025. As global warming begins to have serious effects there will be mounting pressure to reduce coal use. Unfortunately, due to its abundance and our need to replace some of the energy lost from the depletion of oil and gas, the decline in coal use will not be as dramatic as seen with those fossil fuels. The model has coal use decreasing evenly from its peak to a production level similar to what it is today, giving the curve shown in Figure 3.

Figure 3: Global Coal Production, 1965 to 2050

Of course the increased use of coal carries with it the threat of increased global warming due to the continued production of CO2. Many hopeful words have been written about the possibility of alleviating that worry by implementing Carbon Capture and Storage. CCS usually involves the capture and compression of CO2 from power plant exhaust, which is then pumped into played-out gas fields for long term storage. This technology is still in the experimental stage, and there is much skepticism surrounding the security and economics of storing such enormous quantities of CO2 in porous rock strata.

Hydro

If coal is the ugly stepsister, hydro is one of the fairy godmothers of the energy story. Environmentally speaking it's relatively clean, if perhaps not quite as clean as once thought. It has the ability to supply large amounts of electricity quite consistently. The technology is well understood, universally available and not too technically demanding (at least compared to nuclear power). Dams and generators last a long time.

It has its share of problems, though they tend to be quite localized. Destruction of habitat due to flooding, the release of CO2 and methane from flooded vegetation, and the disruption of river flows are the primary issues. In terms of further development the main obstacle is that in many places the best hydro sites are already being used. Nevertheless, it is an attractive energy source.

Figure 4: Global Hydro Production, 1965 to 2050

Development will probably continue in the immediate future at a similar pace as in the past. The model for hydro power has its capacity increasing by almost 40% by 2050. This projected growth is gradually constrained toward the middle of the century by two main factors: most useful river sites are already in use, and water flows will gradually be reduced due to global warming. There may also be a general loss of global industrial capacity (and/or rising development costs) due to oil and gas depletion. Nevertheless, the pressure on hydro power to replace energy lost from oil and gas depletion will support continued development even in the face of such constraint.

Nuclear

The graph in Figure 5 is a mix of data synthesis with a bit of projection. I started with a table of reactor ages from the IAEA (reprinted in a presentation to the Association for the Study of Peak Oil and Gas), the table of historical nuclear power production from the BP Statistical Review of World Energy 2007 and a table from the Uranium Information Centre showing the number of reactors that are installed, under construction, planned or proposed worldwide.

The interesting thing about the table of reactor ages is that it shows the vast majority of the world's operating reactors (361 out of 439 or 82% to be precise) are between 17 and 40 years old. The number of reactors at each age varies of course, but the average number of reactors in each year is about 17. The number actually goes over 30 in a couple of years.

Two realizations formed the basis for my model of nuclear power. The first was that reactors have a finite lifespan averaging around 40 years, which means that a lot of the world's reactors are rapidly approaching the end of their useful life. The second realization was that the construction rate of new reactors and their average capacity can be inferred from the UIC planning table. We can therefore calculate the approximate world generating capacity with reasonable accuracy out to 2030 or so.

The model takes a generous interpretation of the available data. It assumes we will build all the reactors shown in the UIC data referenced above: six plants per year for the next five years, nine plants per year for the subsequent ten years, and ten plants per year until 2050. The model further assumes that all reactors will be granted life extensions to 50 years from their current 40, and that no plants will be prematurely decommissioned. It also assumes that each plant generates an average output equivalent to 1.53 Mtoe per year. The derivation of this figure is given in the model data available here.

Figure 5: Global Nuclear Production, 1965 to 2100

The drop in output between 2020 and 2037 is the result of new construction not keeping pace with the decommissioning of old reactors. The argument for a peak and subsequent decline in nuclear capacity is very similar to the logistical considerations behind Peak Oil - the big pool of reactors we currently use will start to become exhausted, and we're not building quite enough replacements. The rise after 2037 comes from my estimate that we will then be building 10 reactors per year compared to 6 per year today. The net outcome is that in 2050 nuclear power will be supplying about the same amount of energy that it is today.

A number of factors may act to increase that output. Those changes could include the uprating of existing reactors to produce more power than their original design specification, an increase in the size of future reactors and/or a building boom prompted by concerns about global warming and the decline of oil and gas supplies.

Restraining the increase will be economic factors (construction will become more expensive as oil and gas deplete, driving up the cost of materials and transportation), and continuing public opposition to nuclear power plants, waste storage and uranium mining. At some point uranium mining itself may also become a bottleneck - the current world production of about 50,000 tonnes of uranium per year could need to increase to around 70,000 tonnes per year in order to fuel the increased number of reactors. Of course the amount of additional uranium required will depend entirely on the number of new plants that actually get built.

A number of advanced reactor technologies are presently under investigation or development, including high energy "fast reactors" that produce less waste, reactors that can use more abundant and cheaper thorium as a fuel, and "pebble bed" designs that promise improved safety. None of these technologies are commercially available (and are unlikely to be within the next decade or two), so they have not been incorporated into the model.

Renewable Energy

Renewable energy includes such sources as wind, photovoltaic and thermal solar, tidal and wave power, biomass etc. Assessing their probable contributions to the future energy mix is one of the more difficult balancing acts encountered in the construction of the model. The whole renewable energy industry is still in its infancy. At the moment, therefore, it shows little impact but enormous promise. While the global contribution is still minor (at the moment non-hydro renewable technologies supply about 1% of the world's total energy needs) its growth rate is exceptional. Wind power, for example, has experienced annual growth rates of 30% over the last decade, and solar power is doing about as well, though from a lower starting point.

Proponents of renewable energy point to the enormous amount of research being conducted and to the wide range of approaches being explored. They also point out correctly that the incentive is enormous: the development of renewable alternatives is crucial for the sustainability of human civilization. All this awareness, work, and promise give the nascent industry an aura of strength verging on invincibility, which in turn supports a conviction among its promoters that all things are possible.

Of course, the real world is full of unexpected constraints and unwarranted optimism. One such constraint has shown up in the field of biofuels, where a realization of the conflict between food and fuel has recently broken through into public consciousness. One can also see excessive public optimism at work in the same field, where dreams of replacing the world's gasoline with ethanol and biodiesel are now struggling against the limits of low net energy in biological processes.

The key questions in developing a believable model are, what is the probable growth rate of renewable energy over the next 50 years, and what amount of energy will it ultimately contribute? I do not subscribe to the pessimistic notion that renewables will make little significant contribution. However, I think it's equally unrealistic to expect that they will achieve a dominant position in the energy marketplace, due to their late start and their continuing economic disadvantage relative to coal.

In order to project realistic growth rates for renewable energy sources I have used the same mathematical approach as I used for hydro. Data on recent global production of wind, solar photovoltaic and other forms of renewable energy was used as the starting point for the projections. Excel trend lines were fitted to the data and the equations generated in the process were used to extrapolate the growth of each source. As we saw previously, the closeness of the fits as demonstrated by the R-squared values on the graphs gives a certain degree of confidence in the projections.

These projections should be treated with a great deal of caution. Because both the wind and solar power industries are still so new, it is possible that they may exhibit higher growth rates in the future, thus making the following projections too conservative. On the other hand they may run into unexpected constraints that would skew the outcome in a more pessimistic direction. Due to the youth of the industry there is very little historical production data to use in establishing the trends. This scarcity of data makes statistical projections less trustworthy, as large discontinuities in production from year to year may render the curve fits unreliable. On the other hand, there is at least some basis for the projections beyond the enthusiasm of the proponents or the gainsaying of their detractors. The projections should be regarded more as thought experiments - do they seem reasonable given your own assumptions of how the energy world works? If they seem unreasonable (either too high or too low), what is the evidence that will dispute them?

Wind

Data on the global production of wind energy from 1997 to 2005, collected by the World Wind Energy Association and reprinted in this graphic, was used as the starting point for the projection shown in Figure 6. The closeness of the fit of the calculated curve to the actual production data, as indicated by the R-squared value of .998, gives us a reasonable degree of confidence in the projection.

Figure 6: Actual and Projected Wind Power, 1997 to 2050

There are a number of factors that may act on the future development of wind power. There is no doubt that it is an attractive replacement for coal or gas-fired electricity generation, at least within the limits imposed by the inherent variability of wind power. If that limitation can be addressed, either through cheaper energy storage techniques to bridge periods of low wind or smart grids that can tolerate larger amounts of variable power, a significant constraint to rapid and extensive wind development may be removed. The other potential constraint is the ever-present threat of oil and natural gas depletion. The rising cost of oil and gas may drive the cost of industrial production of all kinds up sharply before wind power has achieved a significant presence.

As in the case of nuclear power there will be pressures to speed up the development of wind power because of global warming and the depletion of oil and gas, as well as restraining forces imposed by economics, technical feasibility and perhaps some public resistance to having turbines in their neighborhood.

All in all, with a projected growth of 2200% from now until 2050 it looks as though wind is the renewable energy source that will make the most difference to the world's energy mix over the next 50 years.

Solar Photovoltaic

The data for actual solar photovoltaic production were compiled from here, here and here. This time, a third order polynomial was used to project the historical trend based on data from 1996 to 2006, and once again the fit is good enough to give some confidence that the observed trend is real. Though the growth of solar power in percentage terms is spectacular (an increase of 12,000% by 2050), given the lower starting point the contribution of solar power in 2050 will amount to only half that of wind. However, wind and solar technologies are different enough in their application that this amount of solar

power should make a dramatic difference in the lives of many around the world.

Figure 7: Actual and Projected Solar Power, 1996 to 2050

Other Renewables

In the category of "other renewables" we have such sources as geothermal, biomass, tidal power etc. Production figures for these sources were obtained from the Energy Information Agency. After removing the contribution of wind power from the aggregated figures, the historical production was again projected mathematically. In this case a linear trend line provided the best fit, which seems sensible - biomass is the largest contributor, and it is a very mature energy source, unlikely to exhibit exponential growth in the near future.

Figure 8: Other Renewable Energy Production, 1990 to 2100

Putting the Energy Sources in Perspective

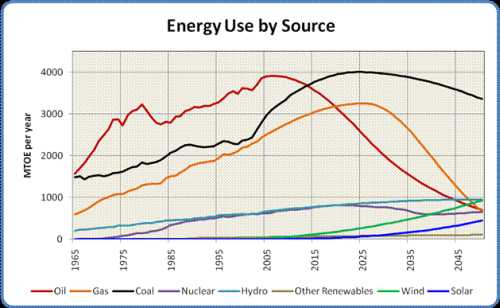

Figure 9: Energy Use by Source, 1965 to 2100

Figure 9 shows all the above curves on a single graph, giving us a sense of the relative timing of the various production peaks as well as the rates of increase or decline of the different sources. As you can see, fossil fuels are by far the most important contributors to the world's current energy mix, but oil and natural gas will decline rapidly over the coming decades. By the middle of the century the dominant player is coal, with oil, gas, hydro, nuclear power and renewables making very similar contributions to the world's mid-century energy supply.

Figure 10: The Global Energy Mix in 1965

Figure 11: The Global Energy Mix in 2005

Figure 12: The Global Energy Mix in 2050

Figures 10-12 shows the changing contribution of each energy source relative to the others over time. There are three interesting things to note about this progression.

The first is the large role that coal plays in the global supply picture. That situation is not entirely unexpected, but it hints at the difficulty we will have trying to replace our dirtiest and most dangerous energy source as our supplies of oil and gas decline.

The second is the increasing diversity of energy sources over time. This change is a good thing, as it indicates that various regions will have a much wider range of energy options available to them than in the past.

Finally, by mid-century energy sources that do not generate greenhouse gases may be supplying 40% of the world's power as opposed to 13% today and only 5% in 1965. Combined with an overall (albeit involuntary) reduction in global energy use by 2050, that shift bodes well for reducing the carbon dioxide our civilization exhales into the atmosphere.

Figure 13: Total Energy Use, 1965 to 2050

Figure 13 has all the energy curves added together to show the overall shape of total world energy consumption. This graph aggregates all the rises, peaks and declines to give a sense of the complete energy picture. The graph shows a strong peak in about 2020, with an ongoing decline out to 2050. The main reason for the decline is the loss of oil and gas. The decline is cushioned by an increase in hydro and renewables over the middle of the century, and averages out to 1% per year.

Fuel vs. Electricity

The energy we use can be broadly categorized into two classes, fuel and electricity. The former consists of oil and gas, the two sources that will be in decline over the next half century. The amount of electricity we produce from all other sources including coal will increase, though not enough to offset the decline in fuels in terms of the energy they supply. Figure 14 shows show how the split between the two classes of energy will change over the next 45 years.

Figure 14: Fuel and Electricity Use, Today and 2050

In addition to the loss of transportation mobility it represents, the loss of the enormous contributions of oil and natural gas means that the total amount of energy available to humanity by the middle of the century may be only 70% of the amount we use now. That shortfall contains an ominous message for our future that is the subject of the next section.

The Effect of Energy Decline on the World's Population

World Population Estimate

In order to assess the impact of declining energy supplies on the world's future population, we first need to establish what that population will be.

In the past I have argued that a drastic reduction in the world's population was likely over the course of the coming century. That expectation was based on my estimate of the impact of energy shortages, fresh water depletion, soil fertility depletion, the decimation of oceanic fish stocks, pollution, biodiversity loss, climate change and economic disruption. It is very hard to make that case, however - not because the problems I list aren't apparent, but because the causal links to human population decline are very difficult to establish conclusively.

Accordingly, for this analysis I have adopted the generally accepted population projection published by the United Nations: a decreasing rate of growth to a population of about 9 billion in 2050. This projection is known as the Medium Fertility Case. As you can see from the graph in Figure 15 it matches perfectly with the projected trend of actual population growth over the last 20 years.

Figure 15: Actual and projected World Population Growth, 1985 to 2050

The Effect on Average Per Capita Energy

One of the interesting, though very high-level, ways to measure of global wealth is to calculate the average energy available to each person on earth. While the resulting per capita average doesn't reflect the disparity between rich and poor individuals or nations or let us know what sorts of things people might do with their energy endowments, it can give us a general feeling for how "energy-wealthy" the average global citizen is, especially compared to other times.

Fortunately, the energy analysis we have just completed gives us the tool we need to establish this measure. By simply dividing the total energy available in each year by that year's population we can construct the graph shown in Figure 16.

Figure 16: Global Average Per Capita Energy Consumption, 1965 to 2050

As you can see, the rising population and falling energy supply combine to produce a falling per capita energy curve. In fact, if these models of energy and population are correct, we can expect to see a drop of almost 50% in average per capita energy by 2050, from 1.7 toe/person to 0.9 toe/person. Each person alive in 2050 will have available, on average, only half the energy they would have today.

The Effect on Countries

Unfortunately the world is not a uniform place, and measures like "average per capita energy" don't really tell us much about how the world might look in 2050. To gain a bit more insight it is helpful to think of the world as being composed of rich and poor nations, where their wealth is characterized by their total energy consumption and whose population growth is expressed in their Total Fertility Rate.

An interesting insight appears when you sort the world's nations by their per capita energy consumption. The nations and regions at the bottom of the consumption scale (Africa, Bangladesh, India, Pakistan, Peru, Indonesia and much of Southeast Asia) all have very high fertility rates, well over the replacement rate of 2.1 children per woman. In fact, when normalized for population size, the average TFR of the poor nations is 3.0. In contrast, the group containing all the other nations is well below the replacement fertility rate at around 1.8.

The implication is that poor nations are going to face double jeopardy. Their populations will increase even as their already low energy consumption drops further. In addition, as per capita energy consumption drops world-wide, some nations that are not currently considered "energy-poor" will be impoverished enough to join the group at the bottom, thereby swelling its ranks even further.

The Growing Divide Between Rich and Poor

In order to get some idea of the magnitude of this effect, I have associated each of the 63 countries or regional groupings in this analysis with their current population, total current energy consumption and their population in 2050. I have arbitrarily decided that a per capita consumption of 0.75 toe/yr is the dividing line between between poverty and wealth. 0.75 toe/yr is a bit less than half the present world average, and only one tenth of the energy consumed by an average American.

The countries and regions that currently fall below that poverty line include Bangladesh, Philippines, Pakistan, India, Peru, Indonesia, Ecuador, Colombia, Egypt, much of Africa, many Asian Pacific nations and some Eurasian countries. Altogether they have a population of about 3 billion people. The rest of the world's nations, from Algeria to Kuwait, are in the rich half of 3.5 billion people.

In order to assess the effect of declining average per capita income, I decided to spread the pain evenly. The assumption is that most countries will see a similar drop in their level of energy consumption. While that expectation may not be completely realistic, it seems close enough for the purpose of this exercise. The result is that countries with a per capita consumption between 0.75 and 1.5 toe/person will lose enough energy to be counted in the group of poor nations.

The countries and regions that drop from rich to poor status include Algeria, Turkey, Mexico, Thailand, much of Central and South America, the non-oil-producing nations of the Middle East, and - most significantly - China.

When we add up the populations in 2050 of the rich nations that are left, it comes out to only 1.6 billion. Remember, their populations fell due to lower fertility, there are fewer of them and they lost China to the ranks of the poor.

The population of the poor nations is where the shock comes. Their total population in 2050 adds up to over 7 billion people. That number is more than the total population of the Earth today, all living at an energy level somewhere between Bangladesh and Egypt.

Figure 17: World Population at low and high energy consumption levels, today and 2050

Conclusion

How many ways are there to say the world is heading for hard times? Losing most of our oil is bad enough, and losing most of our gas as well borders on the catastrophic. Combining these losses with the exponential growth of those nations that can least afford it is nothing short of cataclysmic. The ramifications spread out like ripples on a pond. There will be 7 billion people who will need fertilizer and irrigation water to survive, but would be too poor to buy it even at today's prices. Given the probable escalation in the costs of fertilizer and the diesel fuel or electricity for their water pumps, it isn't hard to understand why the spread of famine in energy-poor regions of the world seems virtually inevitable.

In normal times the poor would appeal to the rest of the world for food aid. However, these times may be anything but normal. Even the shrinking population of the rich world will see its wealth eroded by the drop in energy supplies and the increasing cost of producing the energy they do have. This decline in their wealth will in turn erode any surpluses they might otherwise have donated to international aid. In any event, there will be over twice as many hungry mouths crying for that aid, with less and less of it available.

This assessment doesn't even consider the converging and amplifying impacts of the other problems I mentioned above: the loss of soil fertility and fresh water, the death of the oceans, rising pollution, spreading extinctions and accelerating climate change.

The solution to this dilemma, if solution there may be, does not seem to lie in some Deus ex Machina or in a technological revision of the parable of the loaves and fishes. If the dark visions outlined in this article come true, we will be faced with a world in which the only way forward is to accept that Mother Nature does not negotiate. We must use our considerable intelligence to figure out ways to live within the ecological budget we have been allotted. More than that, we must change our values away from our current paradigm of growth, competition and exploitation to one of sustainability, cooperation and nurturing. The longer and tighter we cling to our present ways, the more damage we will ultimately inflict on ourselves and the world we live in. For many, the time for such a change has already passed. For a fortunate few there may yet be enough time to move toward the new ways of living and being that will be required in this brave new world.

I just posted a note in DrumBeat about a new, extensive NPR/Marketplace (radio) series they're doing called Consumed: Is our consumer society sustainable? highlighting, in particular, an interview about "overshoot" with Jared Diamond. This is the first time I've heard the topic hit the general media in such a direct way. LINK HERE

So essentially this is about as good as it gets as far as energy availability. And we only get to stay at this point if we take immediate action, which we're not going to do.

Should be an interesting next ten years.

My research shows that the energy situation is even tighter. http://www.peakoilassociates.com/POAnalysis.html

Paul this is great work. Taking your conclusion at face value I have a feeling that the OECD could survive nicely on a 50% cut in energy use per capita. Better housing, more efficient travel and working practices, better efficiencey in agriculture, less pointless consumerism etc. Of course the economy may be totally screwed for years.

This is just a feeling - so I was wondering if you had a chart that showed how we use our energy - so we could see where painless cuts could be made.

Moving on to not take your work at face value, we could build in an acceleration in the building of renewables. Right now the driver is half hearted mitigation of climate change and when the world wakes up to energy decline do you not think we will see a vast expansion of wind and solar. In particular, you don't seem to include direct solar - virtually non-existant now but has massive potential. This is simple technology - a magnifying glass on a sunny day.

What's more, you mention famine and I'd tend to agree that we are facing global famine right now - so perhaps the population growth curve will be less agressive.

So there are a number of ways to tweak these variables that produce a better out come for many, simulatenous with a disaster for many others.

No doubt though we are headed for interesting and difficult times. The last half of the 20th century only provided a respite in human suffering.

One of the things I've realized in the last couple of weeks is that most of the technological "stuff" we are looking to for mitigation (the windmills and electric cars and vertical farming) may help a lot, but it's largely going to help the people who don't need helping anyway. It's probably not going to help the people who will really need it in 20 or 30 years, because they largely can't afford it now, and certainly won't be able to afford it in 25 years.

Can direct solar gain enough traction and provide enough benefit to the 6 billion people who will probably be living on two dollars a day in 2050, even if they are two 2006 dollars? All low-tech and alternative tech approaches will help someone somewhere, but we're soon going to be facing a giant balloon of impoverishment in the developing world that is going to be pretty intractable.

We may be faced with a triage situation: (I) those who will survive without help, (II) those who will die even with help, and (III) those who may survive with help. What has horrified me in my latest number crunching is just how big Category II will probably be, and how small Category III is likely to be.

I suspect the world will rapidly polarize into a bimodal distribution: we in the developed world will survive even without fourth generation photovoltaic panels, while 6 billion may not be able to afford fertilizer at 2050 prices.

This theme is going to be developed a little more in Part 2.

One of my first questions concerns your increase from 6 to 12% hydro. I just don't see where potential sites still exist, esp in the industrialized nations. Unless you see a big increase in pumped storage. As you note, it is doubtful the third world could afford the power.

What do you feel is the likelihood of North Africa becoming the powerhouse of Europe, through thermal and pv solar? At 6% in your chart, I imagine not much.

About the hydro, hey I'm trying to be optimistic here! You may be right, and that's one of the reasons I have the hydro curve flattening out over time.

About North Africa - anything is possible: "Predictions are hard, especially about the future." Solar PV and thermal will play a role somewhere, but if I had to bet I wouldn't bet on North Africa, unless Europe decides to fund it. And in that case I'd bet it would end up benefiting Europe a whole lot more than North Africa.

Actually hydro generation in US and in many other places has recently been falling.

Many factors affecting it - climate change, increased water demands for irrigation and by the population, everything adds up and the trend is negative. I can hardly see these factors reversing, quite the opposite actually.

Expecting hydro to raise its share world-wide is obviously assuming a massive program in the third world. How realistic this is I leave up to you to decide.

Unfortunately I have to conclude your optimism is quite crossing the borders of scientific realism. Same goes for wind - expecting it to surpass both hydro and nuclear based on a track record of 5 years, emerging from virtually non-existent source is... maybe way too much.

I'll let you and Pitt duke it out over the global prospects of hydro, and you and Nick can hash out the potential of wind while you're at it. For now I'm content to split the difference and disappoint both sides.

Significant hydro development may be confined to China and Canada, but I'd bet South America and Russia will put on a push as well. Regarding wind and solar, ¿Quién sabe?

No need for duking - we're gathering evidence, not disagreeing.

LevinK is pointing out that hydro production is falling in some places, although - as your graph shows - it's still growing overall and is currently at its highest level ever. I'm pointing out that substantial hydro potential still exists, even in some developed countries. No conflict.

Two things to keep in mind:

1) It's about a 50% increase in output, as compared to a 100% increase in share.

2) This list suggests China, at least, has substantial hydro potential left, as may Canada. According to this estimate from Turkey, the amount of economically viable hydro power in the world is about 9TWh/yr, or about triple its current level.

So it may not be unreasonable.

All dams should be taken down now.

Salmon Advocates Say Kill Dams, Not Sea Lions* - The NewStandard

The Commission could not kill more than one percent of the sea lion population. ... with mortality rates on some rivers reaching 92 percent, according to ...

newstandardnews.net/content/index.cfm/items/4688

What's being proposed here is human feed lots

and no other creature is necessary.

Thee Yangtze, Colorado and the Nile are not making it

to the sea.

We don't have five years. Bakhtiari's WOCAP Model

is the operative one.

I note that financing these wonderous projects

is verboten here.

Reason:

We have no idea how much debt is in the World now.

Since 07/17/07 the process has begun to find out.

With the DJIA at less than 12 750 hedge funds will be carried

out feet first.

From CalculatedRisk:

That’s actually why I find those emails quoted in the indictment to be so explosive. I have spent a lot of years learning to decipher coded language about regulatory-not-exactly-improprieties-but-perhaps-areas-of-concern and other corporate-speak ways of putting it that I’m utterly blown away by the unvarnished language being used here. You just don’t accuse a major account like WaMu of out-and-out violation of safety and soundness regulation unless the conduct is egregious in the extreme, or you think it is clear that you are being lined up for bagholder duty, or both. It sure sounds to me like WaMu wanted to tell eAppraiseIT what to do, while having eAppraiseIT do the scut work plus the small matter of making all the relevant warranties in the utterly certain event it backfired. Mortgage market participants can be so amazingly short-sighted sometimes it’s hard to believe, but somebody at eAppraiseIT seems to have figured out who the sucker at the table was. No doubt they wouldn’t be on the receiving end of a civil suit from Mr. Cuomo if someone higher-up had listened to whatever internal employee called bull on this one.

Why didn’t they listen? Why doesn’t any corporation ever listen? Because the WaMu account is huge, and nobody wants to stop a gravy train. The indictment also includes snippets of emails suggesting that WaMu dangled other business relationships outside the appraisal management function in front of First American if it rolled over. Which is more or less exactly what lenders to do appraisers all the time: offer repeat business if they play ball, or being kicked off the team if they don’t.

...These days appraisers have the same pressures to play ball and absolutely none of the protections of being employees. I wonder if we haven’t gotten to that point where someone with nothing left to lose has nothing left to lose. The lenders are asking appraisers to take personal liability for inflated appraisals, while offering them no salary (protection from falling volume cycles), no benefits, no institutional legal or compliance support. Even the per-deal fee we pay has become typically paid only out of closing proceeds. (We used to pay for the appraisals up front out of an application fee, so the appraiser got paid even if the loan didn’t close. These days the appraiser often never gets paid if the loan doesn’t close because the broker has nothing to pay it with.) And guess who is the target of the Cuomo indictment? Not the lender doing the bullying. At some point these appraisers have to realize that they don’t lose much by going state’s evidence and providing the other half of those email chains. And that would mean a Very Bad No Good Rotten Day for everybody."

http://calculatedrisk.blogspot.com/2007/11/whats-wrong-with-approved-app...

Nobody wants to stop the gravy train, but too many people

are noting that the bridge ahead has been taken out

and not only are the brakes not being applied but the engineers are trying to figure out how to accelerate

the train further.

Arkansaw of Samuel L Clemens

I think it is a given that in the near to medium term (up to 5-10 years) we will have a financial "reset" in the developed world - most likely taking the form of hyperinflation, wiping out all those debts.

Whatever comes next will have to be more sustainable (likely to be much more regulated system) and will be able to provide the financial basis for the projects on the line. After the day of reckoning people will have to finally deal with the fact that superstition based capitalism can't last long.

My take, IMHO (thanx for the reply BTW-;}):

We are having hyperinflation (HI) now.

That's how the Top 1% Bonuses are being factored.

$160 million Golden Parachutes for "humiliated" Merrill CEO,

for instance.

The HI is being hidden in the $415 Trillion SIV's.

What's happening now is that the HI's being exposed.

A wheelbarrow full of SIV's can buy a loaf of bread-

h/t Weimar Republic.

But investors are demanding return of their principle.

Fear stalks the streets.

What do you actually have in your hand now.

That's deflation.

Pennies become dollars.

A coke for a nickel. A beer for 15 cents.

The only MegaProjects are Gov't CCC Work Projects.

Arkansaw of Samuel L Clemens

I still think it is a push, but thanks for your links. The problems we have had recently in filling reservoirs to generating capacity weighs heavy, and I think this will get progressively worse with climate change. Properly sizing a watershed for hydroelectric potential and reservoir size requires decades of flow regimes, and I think future variability will make this a tough call.

Your Canadian link states that hydro is a consequence of climate and topography, and goes on "Practically all hydroelectric-power sites in Canada that are reasonably close to load centres have been developed". The remaining potential is the far north, developed at great economic and environmental cost. I don't believe many such schemes, like the idea of reversing the flow of Quebec watersheds some years past, will make it in the future.

I don't wish to dwell on the environmental costs of large hydro, but they are considerable. The costs of China's Three Gorges is still being tabulated, and in the northwest, I wonder how long we will continue trucking or barging smolts to the ocean. (There are some new developments and ideas for free swimming passage)

Another issue inadequately addressed is reservoir silting. I am a guarded proponent of hydro, including microhydro where I see many small drops in the bucket, but skeptical in it's ability to supply significant postpeak energy.

There is something called Lake Effect. When the lakes and seas in cold regions are iced over, they stop supplying moisture for rain and snow. If they are still open during the cold part of the year, you can get some amazingly deep snowfalls.

If the Arctic ice cap doesn't form next year, Canada's hydroelectric potential could take a sudden jump.

The developed world will have to restrict it's use of energy resources. I doubt the Category II people will just agree to go away and die peacefully.

The developed world will not voluntarily impoverish itself in anyone else's favour. The good folks in Category II will not agree to just go away and die. What's the outcome?

If it comes to that, and it probably will, war. However, cutting the U.S. share of energy consumption from 30% to 15% wouldn't necessarily impoverish us. Doing it in time would require close to socialism in the U.S. although.

I'm also thinking that the Category I folks may not be who you think they are. Most of the developed world has exhausted its cheap energy resources. At some point the Category II and III people are going to figure out they should keep their resources for themselves and not sell them to the developed world for worthless pieces of paper.

TJ,

I agree that the poor will realize they are being screwed and become somewhat unruly. However, we then move into the realm of nastiness.

Already I've heard the phrase "resource nationalism" popping up here and there. When we use it about some country, like Venezuela, or Russia; it isn't meant positively.

It's meant to emply that they are using their resources to promote a narrow, nationalistic, political agenda, and that this is illigitimate and unfair. They are also undermining the workings of the free market.

The poorest people in the world don't have money for fertilyzer today. How can their life get any worse?

It's like that Alabama song. "Somebody said that Wall Street fell. We were so poor that we couldn't tell." Civilization will come to an end and the sharecroppers will just continue subsistence cropping away, same old same old.

RobertInTucson

I haven't escaped from reality. I have a daypass.

writerman,

I guess I'm just a commie rat, but I cant see a lot of difference between Venezuela or Russia using its resources for a narrow, nationalistic political agenda and a multinationalal oil company using the money from its production to have a country promote its political/economic agenda as in Exxon and Chevron having the US invade Iraq so they could bid on producing the Iraqi fields under the proposed "oil law" that was dropped as a political hot potato 2 or 3 months ago.

Its a myth that the oil markets have ever been "free". The economic event that made oil into the primary transportation fuel for our economy was switching the navies and the railroads to oil as a fuel from coal, which happened about 1910-1920 for the US and Great Britain. Once that happened oil became of such strategic value that countries began entire military campaigns based on access to oil. Being able to ship men and material quickly is the difference between military campaigns 150 years ago and today. Surely no one thinks that the US military could survive in Iraq on the local food and march to and from engagements, which is how all armies operated for all time before the invention of the railroad, military trucks and navy landing vessels powered by engines instead of oil and airforces.

The end of dense easily transported fossil fuels is going to totally change the nature of war.I expect to see most of the remaining oil confiscated by the militaries of the countries that have oil. That's why Jeffry Brown's Export Land phenomena is inevitable. The countries that see that the effectiveness of their military is dependent on fuel for military transportation will force all oil importers to stop net exports out of their countries. And its probably why the Russians will win in the end unless the US can keep up its empire in the middle east.

I'm an elderly hippy and a peacenik. I'd love to see an end to war, but global wars won't end until all the dense energy fossil fuels are gone. Its hard to see armies operating off of solar arrays and wind turbines. If pocket nfission reactors are possible then all bets are off, but I can't see that modern military can survive the end of oil and coal. The question is can humanity survive the end of oil and coal. Bob Ebersole

The developed world will not voluntarily impoverish itself in anyone else's favour. The good folks in Category II will not agree to just go away and die. What's the outcome?

Speak for yourself. I would gladly enter on the path of energy decent to try to mitigate the coming disaster in the developing world. Are you saying that you are unwilling to give up wealth? Or are you claiming that you yourself are generous and everyone else is an egotistical bastard? I think that concentrating on technologies that can work for everyone is will benefit ourselves as well. For example rather than concentrating on developing highly expensive lithium batteries for hybrid automobiles and planning on using car batteries for balancing the grid, we should concentrate on developing a low cost storage battery based on an abundant material like iron or aluminum (unfortunately lead production is likely to decline in the not too distant future) in order to allow distributed small scale generation from wind or PV. I think that in a couple of decades time we will need such batteries a lot more than we will need hybrid automobiles. We should also be giving top priority to developing local systems of food production which preserve topsoil and recycle nutrients even if such systems are more labor intensive than current agricultural practices and therefore hurt our economy by moving labor resources from other manufacturing enterprises. Our willingness to spend down our resources of top soil in return for short term luxury is one in the surest signs of the structural insanity of our current economic system. The attempt hang on to as much of what we have for as long as possible will make the transition from an economy which assumes that the world is both an infinite mine and an infinite garbage dump, to one in which we live in dynamic equilibrium with the biosphere even more painful and disastrous than it would be otherwise.

"we should concentrate on developing a low cost storage battery based on an abundant material like iron or aluminum (unfortunately lead production is likely to decline in the not too distant future) in order to allow distributed small scale generation from wind or PV."

I have nothing against batteries of the kind you mention but there are some possible options of going beyond that.

Title:

Lightweight flywheel containment

Document Type and Number:

United States Patent 6756091

Link to this page:

http://www.freepatentsonline.com/6756091.html

Abstract:

A lightweight flywheel containment composed of a combination of layers of various material which absorb the energy of a flywheel structural failure. The various layers of material act as a vacuum barrier, momentum spreader, energy absorber, and reaction plate. The flywheel containment structure has been experimentally demonstrated to contain carbon fiber fragments with a velocity of 1,000 m/s and has an aerial density of less than 6.5 g/square centimeters. The flywheel containment, may for example, be composed of an inner high toughness structural layer, and energy absorbing layer, and an outer support layer. Optionally, a layer of impedance matching material may be utilized intermediate the flywheel rotor and the inner high toughness layer.

http://www.sae.org/technical/papers/981276

Title: A High Useable Energy Density Flywheel System Making Solar-Powered Hale Uav a Realistic Technology

Document Number: 981276

http://www.nec.co.jp/eco/en/2007_1/h03.html

"Like Metal!"

- Development of Bioplastic with High Thermal Conductance

So the fate of mankind depends on his ability to get rich?

I better do whatever it takes, I mean whatever it takes, so that My children might survive.

This is one F*#@ed world we live in.

Has it ever been any different?

No, it has never been any different, which is why individuals and societies can't rely for a decent future on a model of perfecting human nature. You have to come up with solutions that work within human nature.

For example, someone in this thread asked whether there will be capital available for financing energy efficiency and alternative energy projects. There will be capital available, but the question will be whether it can be pried out of the hands of those who have it. The answer will depend at least partly on decisions being made right now. For example, should the Fed cut interest rates even if it leads to higher inflation, or should the Fed maintain or even raise rates to protect the dollar at the risk of deflation?

The answer is to choose inflation, because it forces the holders of capital to keep their money in the game. Inflation is like an ante or blinds, it forces action. (You can't just sit there on your chips or you soon go broke.) But if deflation gets started, all the holders of capital have to do is sit and watch risk-free as stuff gets cheaper and the cash in their mattresses gets more valuable.

Paul,

A really excellent and sobering piece, there's an awful lot of stuff here to mull over.

I remember reading stuff like this eons ago, like in the "Population Bomb" and "Limits to Growth" and look were still here and everyone I now is far, far, richer than ever before!

Only this time I have a feeling it might be very different.

One of the things I think we'll see is a truly massive growth in the gap between the lifestyles of the rich and poor, not just between us and the poor sods in the third world, but also in the rich world. This is a trend that is already very apparent almost everywhere to a greater or lesser degree, but the trend is unmistakable.

Like I said I believe it'll get dramatically worse. Society will become extremely polarized economically. I think we'll see parallel or multi-tierd systems evolving. Like with healthcare and education, only more and more areas of society will follow this pattern.

One can already see this in the rapid growth of private security guards and the veritable explosion of private armies. There are thought to be around 100,000 private soldiers or mercenaries operating in Iraq at the moment.

I think the elites will retreat behind guarded walls, like they've lived for most of mankinds history, and the rest of us will scratch a living outside. If we get out of hand...

It seems to me that healthcare is a special case. Knock out the middle and lower class access to healthcare, and the system falls apart. The "electrician" cardiologists, cheap vaccines and drugs, the mountains of research dollars or cost of state of the art hospitals need the subsidy of the middle and lower class. They won't stand by themselves on fees from the wealthy.

BS

Most folks choose to lead a perfectly adequate life of moderation but apparently, that is no longer an option thanks in no small part to “financial engineering” and the push for endless wealth.

Nice shot at rationalizing though.

Moe, thanks for an easy-to-understand analogy of why Ben Bernanke regards inflation as infinitely preferable to deflation.

PLAN, PLANt, PLANet

Errol in Miami

Moe_Gamble

its only 150 years since it was perfectly acceptable behavoiur to beat and torture other people to work them to work for free, and to exterminate other people in order to steal their land and consider them sub-human because they were less technologicially advanced tha us. I'm speaking of slavery and the Indian wars, enshrined in that most sacred of documents, the Constitution of the United States of America. Humanity is improving, and fairly quickly considering the long history of war and slavery.

No, we can't rely on this improvement any more than we can rely on any other future projection. The answer to almost all of these improvements is education. History shows us what's possible and the methods that work, and paths to progress. The altruism of America at the end of WWII and the marvelous results from rebuilding our enemy's countries shows what works. Because we were generous with the Japanese and Germans they've become great world citizens and our allies.

The opposite behaviour was shown by the US at the collapse of the Soviet Union. We missed an opportunity to bring peace and prosperity to the formerly communist countries thanks to the greed of the capitalist world view.

We've got the opportunity to be generous again and solve both climate change and the psychotic evils caused by poverty. Approximately 1.6 billion people on the planet live with no electricity, no clean water and no access to any education. Their lives are hopeless, they live on less than $2 American a day, most of them are destitute women without skills in no-western societies. Their children are the kids who become suicide bombers . They are fertile because a child has economic value when you can put him to work in the fields at six or sll her for a sex slave.

If we'd help the deperately poor get renwable energy enough to run lights at night and a computer during the day and provide enough education and access to the internet we'd provide them with hope of a better future for their children. The money it would cost would be about the same price as our collective defense budgets for a few years, and it might result in world peace and prosperity by focusing on something other than greed and war. If we can imagine something, its possible. And it would both save the climate and bring peace and prosperity.

Bob Ebersole

I agree, Paul has put together some excellent work. I also agree with Euan that energy use efficiency and an acceleration of new energy sources could help the situation. We will need much more enlightened political leadership, especially in North America and China, for this to happen. One area where Paul's model may be too optimistic is that there may be less capital available for manufacturing and constructing new energy infrastructure once we have passed peak oil and peak natural gas.

Another tweak to Paul's model could include thorium fuel retrofits to light water reactors and CANDU reactors. This can easily be implemented soon enough to eliminate possible future reductions in U-235 availability.

The decline in capital (specifically the decline in national GDPs) will be addressed in Part 2.

Regarding thorium, pebble beds and IFRs I deliberately excluded them because once you start throwing in speculative technological changes you can't tell where to stop. I decided to stay conservative in that regard.

Thorium in fission reactors goes back at least to the sixties. I was there. (Google General Atomic or HTGR)

Pebble Bed Reactors are not speculative technology.

Gas Cooled Fast Reactors are not speculative technology. Solar Power and Wind are not speculative technology.

You sign the check, you get the plant.

Solar has the fastest ramp up because we can divert 20% efficient solar panels to 2,000% efficient 100X solar concentrators in about six months. There is no chokepoint in the manufacture of concentrators.

Then we go with wind, figuring on about three years to build the capability to manufacture more of the rather expensive gear boxes and blades. The rest of wind is pretty much off the shelf.

Gas Cooled Fast Reactors need lots of uranium metal production, fabrication, and enrichment facilities. These take longer. Pressure vessals are the chokepoint. Building something 30 feel around, three feet thick, out of steel, is not something you can just do in a garage. You have to build about the world's biggest forge and retrain a lot of welders.

Pebble Bed reactors are buildable. They just don't make a lot of sense. Why not the standard Pressurised Water Reactors? We haven't got the technology to cheaply recycle used fuel yet, in competition with enriched uranium at the present price, anyway, so their breeder capability for thorium cycle isn't really applicable.

Thorium fuel can be used in Pressurized Water Reactors, which would be much easier than switching to gas cooled reactors. But you are right on your last point - just reprocessing existing fuel would stretch uranium/plutonium supplies a long way into the future. However, the thorium cycle has some other advantages in terms of reducing waste and proliferation issues.

Euan,

Here is some info on transport for the US at least The source is table 6 from the 2001 National houshold Travel Survey

To or from Work 28%

Shopping 14%

Social & Recreational 24%

Family or Personal Business 19%

Other 15%

There is plenty of room for adjustment in the consumption of energy used in driving. However, as we both know that will require a lifestyle change that may be much harder to accomplish than we think.

By the way I am the fellow who probably overdid the Thank You to you and Stuart in Houston. Anyway thanks again. Take care.

Paul, this is exactly the sort on analysis that needs to be developed, and many thanks for putting in the time, effort, and critical thinking needed to bring it to us.

I would add my support for the possibility expressed by Euan, and others, that the scale up of other sources of energy, particularly renewables, can and will happen much more quickly than you envisage. Three particular examples which illustrate this are wind, Concentrating Solar Thermal (CST), and thin-film Photovoltaics (thPV). SOme points on this perspective:

1. At the moment the pressure behind developing and scaling up these energy sources is what could be called ‘weak forces’ - most of the incentive is coming from a mediocre response to the threat of climate change. Peak Energy on the other hand will provide ‘strong forces’.

2. The ‘strong forces’ are potentially very strong - For example here in the UK, we already pay the equivalent of about $300 a barrel (of oil) for gasoline, without much impact on how we drive.

3. CST looks as if it could provide essentially unlimited amounts of 24/(nearly)7 electricity at prices not very different to cost of conventional electricity today. Some key facts - Solel inc http://www.solel.com/ is building a 553 MW CST plant for PG&E in the Mojave desert; Ausra is building 1000MW of CST capacity for PG&E and |Florida light and power http://www.ausra.com/news/releases/070927.html .

4. Wind power is clearly going to play a major role.

An area of about 100miles x 100 miles in Nevada using current Ausra or Solel technology could provide all of the current electricity needs of the USA. In Europe, ‘under strong forces’ we could get our act together and build such plants in southern Spain and/or North Africa and transmit the power north, as envisaged (for 15% of Europes needs) in the German Aerospace Center report on the ‘Trans CSP’ http://www.dlr.de/tt/desktopdefault.aspx/tabid-2885/4422_read-6588/

5. In terms of day-time decentralised electricity generation, an already emerging new generation of solar PV panels will cost less than $1/W to manufacture, and are much easier to scale up than current silicon wafer PV manufacturing processes. This week First Solar Inc http://www.firstsolar.com/ released it’s Q3 2007 financial results, which show on an audited basis that they are already down to $1.15/W Cadmium Telluride PV manufacturing costs. See also Nanosolar http://www.nanosolar.com/ . When the retail price of panels becomes determined by these sorts of manufacturing costs, the panels will immediately be cost effective for daytime electricity production by consumers in many regions.

6. So I think that there are good grounds for predicting that sometime after Peak (Fossil Fuel) Energy, we will return to a world of cheap, relatively unlimited, non-polluting and secure energy. This energy will probably be even cheaper than it is today.

7. It appears that we can do this with existing technology of kinds which are currently being ramped up. Only one extra breakthrough is really needed to achieve current or better than current energy convenience, that is a breakthrough in the energy density and cost of rechargeable batteries.

8. It seems to me, that the critical issue, is at what rate can we scale these new technologies under the strong forces. My guess is that we can and will do so much faster than envisioned in your current post. Equally it seems obvious that as per your post, there will nevertheless be an interim period where there is some pain, e.g. a phase of recession and higher levels of unemployment, in the developed world, and some disastrous consequences for the poor and week.

It would be great to see the skills of TOD contributors applied to developing and modelling ramp-up scenarios for these replacement sources of energy.

My guess (but I would like to see something more scientific!) is that the forces for this change over will be strong enough to change to the new paradigm within about 20 years.

One of the aspects of the new era will be that the costs of electric energy will put a fairly low price on the upper limit on the competitive price of fossil fuel - at about $20 or so per barrel or so of oil. At some point this will hopefully cap enthusiasm for investing in very expensive, long pay-back projects for extracting non-conventional fossil fuels.

In a sense the economists will have been proved right - market forces will have responded, but not by replacing cheap oil with expensive oil, but by replacing cheap oil with cheap electricity.

I find it heartening to think that the only sources of energy than can respond indefinitely to market forces, may turn out to be those that are renewable.

Homo Semi-Sapiens.

The price of PVsolar may be coming down for two