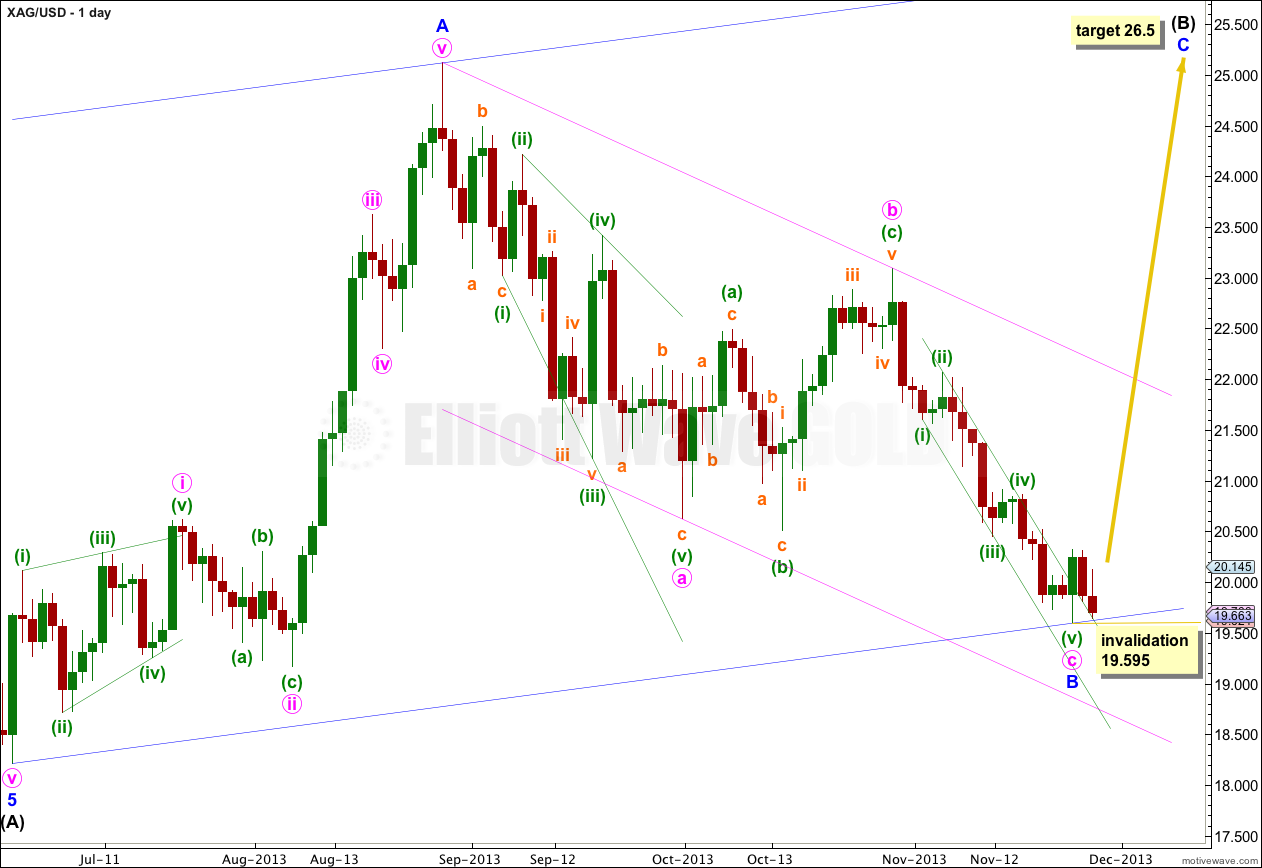

Last week’s analysis of Silver expected more downwards movement towards a target at 18.591 to 18.353. Price did move lower but has failed to reach the target. Downwards movement may have ended at 19.595, 1.004 short of the target zone.

The wave count remains mostly the same.

Minor wave B is now a complete zigzag.

Within minor wave B minute wave a subdivides nicely as a leading expanding diagonal. Within the leading diagonal all the subwaves are zigzags except the third wave which is an impulse. For this piece of movement this structure has the best fit.

Minute wave b is labeled as an expanded flat correction. Within it minuette waves (a) and (b) both subdivide as three wave zigzags, and minuette wave (b) is a 106% correction of minuette wave (a). There is no Fibonacci ratio between minuette waves (a) and (c).

Minute wave c is now a complete impulse. Within minute wave c there are no adequate Fibonacci ratios between minuette waves (i), (iii) and (v).

The narrow channel drawn about minute wave c is drawn using Elliott’s first technique. Draw the first trend line from the ends of minuette waves (i) to (iii), then place a parallel copy upon the end of minuette wave (ii). This channel is now clearly breached by upwards movement which indicates minute wave c is over and the next wave has begun. The upper edge of the channel is now providing support.

Within minor wave C no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 19.595.

At 26.50 minor wave C would reach equality in length with minor wave A.

What is very clear on this hourly chart is the three wave structure for recent downwards movement. If price does not break below 19.595 then I would expect a third wave upwards to begin from here.

Upwards movement for minuette wave (i) is very clearly an impulse. Ratios within minuette wave (i) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is just 0.006 short of 0.618 the length of subminuette wave iii.

Within minuette wave (ii) subminuette wave c is 0.031 short of equality with subminuette wave a.

At 20.820 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

The channel about minuette waves (i) and (ii) is an acceleration channel. I would expect minuette wave (iii) to break through the upper edge of this channel. At that stage I would be confident that a third wave is underway.

Our service is educational, we aim to teach you how to learn to perform your own Elliott wave analysis.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.