Later today, the FOMC will release a statement on monetary policy, following their 2 day meeting. Nobody is expecting them to announce that the Fed Funds rate is changing, but every eye will be reviewing the wording to see if there are hints, or flat out statements, about when the rate will be raised. The consensus seems to be December right now.

Janet Yellen has been talking a lot lately and stating that if the Committee’s view on the economy plays out, then it will happen this year. That is a big if, given the FOMC’s ability to forecast economic activity. She will not have an opportunity to speak after this statement, but that is ok, as there will be countless interpretations of what the statement says.

Most of those interpretations will be focusing on economic growth as reasons for the Fed to raise rates. Either domestic things, like employment statistics or GDP, or if the view is for a delay, then global weakness. This makes sense, as it is one half of the FOMC’s mandate, to promote employment and growth. What no one will be focusing on is the other half of the mandate, price stability.

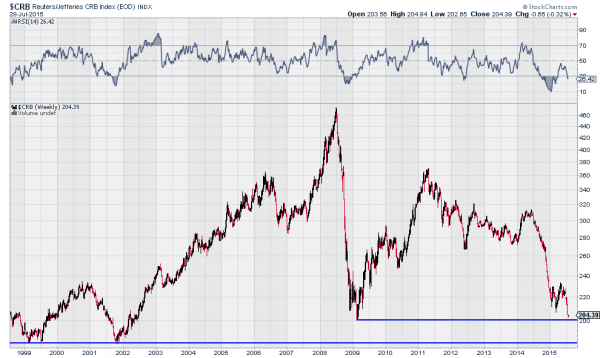

The Federal Reserve has stated that they look to target long run inflation to 2%. It is nowhere near this. In fact, this week, there was a report suggesting they think this will happen by 2025. Yikes! One measure of inflation is the CRB Index. It is not the PCE that the Fed prefers, but a good proxy. The chart above shows this measure for the last 17 years on a weekly basis.

Inflation had been rising into the financial crisis and then dropped like a lead weight. As the Fed slashed interest rates to zero (and beyond with Quantitative Easing) inflation started to rise again, but then a funny thing happened. After peaking in early 2011, inflation has been falling ever since.

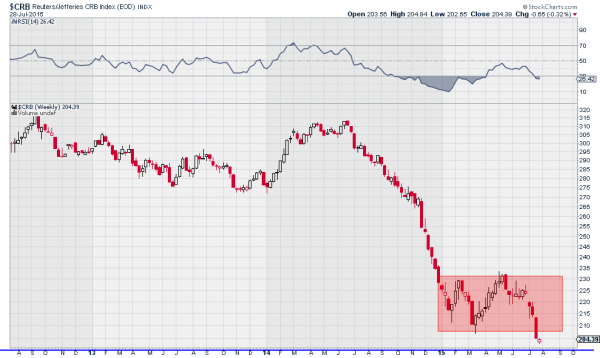

In fact, the recent inflation history is causing a problem for the raising rates crowd. The chart above blows up the last 3 years. It almost seems that as the FOMC started to talk about raising rates at some time in the future, inflation started to fall. The year started with some stabilization, but look at the most recent history in the red box. Inflation measures are breaking out of the box, but to the downside.

This poses an issue for the FOMC to raise rates. No inflation means no pressure to raise rates. Falling inflation means it is the wrong choice. I suspect that following the statement release today all hope for a September rate hike will be gone, and the odds for a rate hike in December will fall as well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.