The XAU/USD pair fell three days in a row as strength in the American dollar continued to weigh on the market. The pair initially tried to break through the $1303 resistance level but reversed and traded as low as $1293.73 an ounce after data out of the United States showed the housing market gathered steam and inflation pressures remained subdued. The Commerce Department reported that building permits advanced 8.1% to 1.05 million pace and housing starts jumped 15.7% in July. According to the Labor Department's data the consumer price index rose 0.1%.

While yesterday's numbers indicate the economic recovery remains on track, this also gives the Fed enough room to keep interest rates low after the end of its asset-buying program. It appears that today's main event will be release of the minutes of the Federal Open Market Committee meeting held on July 29-30. These records should provide some useful insight into what the voting members were thinking at that time.

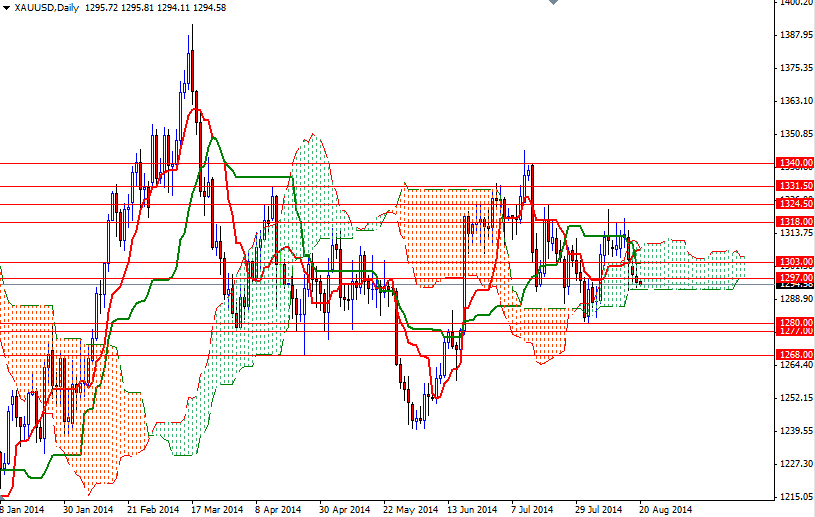

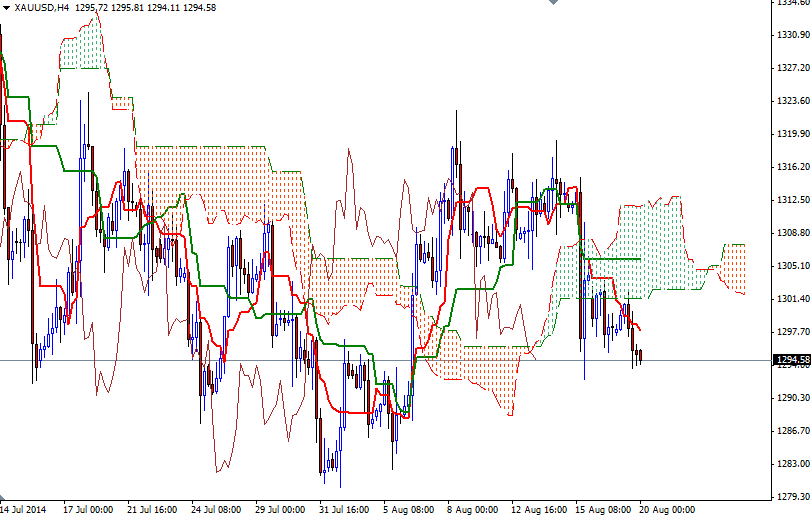

From a technical point of view, yesterday's price action suggest that the bulls are having hard time to gain traction. The 4-hour chart paints a bearish picture as the market trades under the Ichimoku cloud and the Tenkan-sen line (nine-period moving average, red line) moves below the Kijun-sen line (twenty six-day moving average, green line). However, as I mentioned in my previous analysis, the 1292 level where the bottom of the daily cloud resides could be the key here. A sustained break below this level might attract more seller and increase the pressure on the precious metal. If that is the case, I will be looking for 1287/6 and 1280. To the upside, the first challenge will be waiting the bulls at 1303. If the XAU/USD pair successfully climbs above this level, we could possibly see the bulls make a run for the 1308/12 zone.