ALLANA POTASH ANNOUNCES POSITIVE

PRELIMINARY ECONOMIC ASSESSMENT ON SOP PRODUCTION AT ITS DANAKHIL POTASH PROJECT

- After-tax Net Present Value of US $1.6 billion;

- After-tax Internal Rate of Return of 39%;

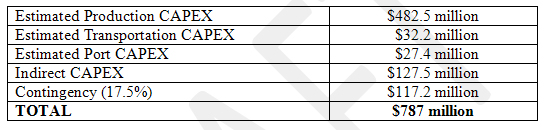

- Total development capital expenditures including mining, processing facilities, port and logistics infrastructure (�CAPEX�) of US $787 million;

- Total operating expenditures (�OPEX�) (including production, sustaining capital, transportation/handling, port, loading costs) FOB on the Vessel of US $130 per tonne;

- PEA is based on Annual Production of one million tonnes of SOP per year using solution mining and solar evaporation ponds;

- Demonstrates Allana�s potential for MOP and SOP operations, both of which have industry-leading CAPEX and OPEX profiles;

- Allana evaluating alternatives to maximize the value of both MOP and SOP resources.

Toronto, Ontario, March 2, 2015 -- Allana Potash Corp. (TSX: AAA) (�Allana� or the "Company") is pleased to announce positive results of an independent Preliminary Economic Assessment (�PEA�) prepared by Ercosplan Ingenieurgesellschaft Geotechnik und Bergau (�ERCOSPLAN�) on the production of Sulfate of Potash (�SOP�) at its Danakhil Potash Project in Ethiopia (the �Project�).

The PEA is based on commercial operations that produce one million tonnes per year (�MTPY�) of a standard SOP product over an estimated operating life of 77 years. The PEA evaluated the potential for SOP production as a separate mining operation from the MOP operation that is the focus of Company�s Feasibility Study (see news release dated Feb. 4, 2013 and technical report prepared in accordance with NI 43-101 available on SEDAR). The PEA examined solution mining of brine with solar evaporation of the brine to a crystal product and reverse flotation of this product for cleaning, followed by transformation of remaining sulfates to a SOP product as the proposed SOP mining and processing method for the project. The PEA for the SOP operation yielded, on a real, unlevered basis, an after-tax Internal Rate of Return (�IRR�) of 39% and an after-tax Net Present Value (�NPV�) of US $1.6 Billion based on a 10% discount rate. SOP is a premium potash product widely used on chloride sensitive crops such as tobacco, fruits and vegetables as well as nuts, with China as the largest consumer.

Farhad Abasov, President and CEO of Allana commented: �Allana is very excited with the positive preliminary economic assessment of an independent SOP operation at its Danakhil Potash Project. The potential for SOP operations, coupled with the Feasibility Study Allana previously completed on MOP operations, demonstrates the uniqueness of Allana�s Project which through its sylvinite and kainitite resources has the potential to produce MOP and SOP with industry-leading CAPEX and OPEX profiles. The PEA�s extremely positive results give Allana great confidence in the SOP potential at the Project and management will evaluate undertaking a full Feasibility Study for the production of SOP. The PEA also allows Allana to move forward confidently with its project finance plans and ongoing talks with potential strategic partners. Allana has retained a financial advisor to assist the Company in its evaluation of various options to maximize the value of the SOP potential for Allana shareholders.�

The mineral resource estimate used for the PEA was completed by ERCOSPLAN in April of 2013 and includes in-situ measured Kainitite mineral resources of 552.3 million tonnes at 19.4% KCl, indicated Kainitite mineral resources of 598.2 million tonnes of 19.5% KCl and an estimated inferred Kainitite mineral resource of 481.8 million tonnes of 19.8% KCl in the Kainitite Member (see news release dated June 26, 2013 and �About Allana� section at the end of this news release). Factoring in mining, pond and processing losses, these resources translate to approximately 77,000,000 tonnes of recoverable SOP product. The Kainitite Member is comprised mostly of kainite, a potassium sulfate mineral that can be processed to SOP, and halite (NaCl, or common salt).

The key economic highlights of the PEA are outlined below (all dollar amounts are stated in US$):

The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the estimates of the PEA will be realized.

For the purpose of the PEA, capital expenditures (CAPEX) were estimated for three main categories: Production using solution mining, solar evaporation and processing of the crystal product to SOP (Production); Transportation and handling of product between the production site and port (Transportation); and terminal facilities at the port in Djibouti (Port). The Production CAPEX includes costs associated with cavern development, the solar evaporation ponds, brine processing, and infrastructure including water and power supply. Solar evaporation of the saturated brine solution is possible at the Danakhil Project due to the year-round hot temperatures, averaging 40�C, and very little rainfall. Salts harvested from the ponds will be cleaned from Halite by reverse flotation and the product will be reacted with potassium rich brine to create a SOP product. Transportation CAPEX costs are based on a company owned fleet of trucks and all support such as maintenance. Port CAPEX costs are based on Allana constructing its own terminal at Tadjoura Port in Djibouti including product unloading and storage, shipping facilities and supporting infrastructure such as power and minor road construction. The table below outlines the estimated capital expenditures in US $ for all categories.

Estimated operating expenditures (OPEX) were also calculated for Production, Transportation, and Port. The OPEX costs in US$ per tonne are outlined in the table below:

Estimated general & administrative and contingency costs as well as the long-term sustaining CAPEX for ongoing buildout of the solution well field plus equipment, vehicle and infrastructure replacements were also calculated in $US per tonne and are outlined in the table below:

The main assumptions used in the PEA are as follows:

|

Production:

Life of Operation:

Mining method:

Processing:

Transport:

Power:

Water:

SOP Price:

Sustaining CAPEX:

|

One million tonnes SOP per year

77 years

Solution mining

Solar evaporation, flotation and reaction of crystal product with brine to SOP

Trucking to Djibouti

HFO generation with fuel shipped to site

Water on site

US$552 per tonne in 2015

US$18.7 million per year, building up to this level over the first 10 years' operations

|

In the PEA, ERCOSPLAN recommends additional flotation testwork and an additional solution cavern to produce brine for further evaporation testwork, to facilitate a Feasibility Study evaluating the potential to concurrently extract both MOP and SOP from the same brine field. Additional studies currently in progress including an Aquifer Stress Test (AST) and Solution Well #3 (SW3) will provide valuable information for this evaluation. The AST is intended to confirm the viability of Allana�s long-term water supply by pumping water at greater than planned production rates from one of the projected water supply fields for an extended period, now complete. SW3 is a production-scale solution well currently in operation to supplement experience from the pilot-scale solution well work from the Feasibility Study, and to produce brines from the Kainitite horizon through to the Sylvinite horizon to optimize solution mining configurations for the Project.

The PEA, with a target accuracy of +/- 35%, was completed as an initial scoping assessment to determine the viability of an independent SOP operation within the Allana mining license in the Danakhil Depression. The PEA on SOP production is independent of the MOP production that has been detailed in the Feasibility Study (see news release Feb. 4, 2013 and the associated technical report prepared in accordance with NI 43-101 available on SEDAR) which remains current and unaffected by the results of the PEA. The SOP operation provides an option, if a second feasibility study incorporating SOP proves positive, to complement or expand upon the MOP operation and various production scenarios will be under evaluation. A technical report in support of the PEA will be available under the Company�s profile on SEDAR and Allana�s website within 45 days of this news release.

About Allana Potash Corp.Allana is a publicly traded corporation with a focus on the acquisition and development of potash assets internationally with its major focus on its potash property in Ethiopia. Allana has the support of three significant strategic shareholders: ICL, one of the world�s largest potash producers, IFC, a member of World Bank Group, and LMM, a member of Liberty Mutual Group. Allana has estimated measured Sylvinite mineral resources of 115.3 million tonnes of 27.8% KCl; indicated Sylvinite mineral resources of 212.1 million tonnes of 28.6% KCl, and an estimated inferred Sylvinite mineral resource of 90.8 million tonnes grading 27.8% KCl, In addition, the Project hosts measured Kainitite mineral resources of 552.3 million tonnes at 19.4% KCl, indicated Kainitite mineral resources of 598.2 million tonnes of 19.5% KCl and an estimated inferred Kainitite mineral resource of 481.8 million tonnes of 19.8% KCl; estimated measured Upper Carnallitite mineral resources of 121.5 million tonnes grading 17.5% KCl, estimated indicated Upper Carnallitite mineral resources of 289.8 million tonnes of 17.2% KCl and estimated inferred Upper Carnallitite mineral resources of 175.5 million tonnes of 16.5% KCl; estimated measured Lower Carnallitite mineral resources of 235.0 million tonnes of 9.7%KCl, estimated indicated Lower Carnallitite mineral resources of 322.2 million tonnes of 8.9% KCl and estimated inferred Lower Carnallitite mineral resources of 369.3 million tonnes grading 7.7% KCl. The foregoing mineral resource estimates are as at April 17, 2013. For more information with respect to the data verification procedures undertaken and the key assumptions, parameters and risks associated with the foregoing estimates, refer to Allana�s Technical Report entitled �Resource Update for the Danakhil Potash Deposit, Danakhil Depression, Afar State, Ethiopia� dated effective April 17, 2013 filed under the Company�s SEDAR profile at www.sedar.com on August 7, 2013.Allana has approximately 325.2 million common shares outstanding. Allana trades on the Toronto Stock Exchange under the symbol �AAA�. For more information, please visit the Company�s website at www.allanapotash.com.

Dr. Peter J. MacLean, Ph.D., P. Geo., Allana�s Senior VP Exploration, is the Company�s designated Qualified Person and has reviewed and approved the technical information presented in this release.

The PEA was prepared by ERCOSPLAN Ingenieurb�ro Anlagentechnik GmbH under the supervision of Dr. Sebastiaan van der Klauw, Eur Geol, PhD who is an independent Qualified Person for the purposes of National Instrument 43-101 and prepared the April 2013 mineral resource estimates disclosed herein.

Cautionary Notes

The PEA is preliminary in nature and is based on a number of assumptions that may be changed in the future as additional information becomes available. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The PEA includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

Except for statements of historical fact relating to the Company, certain information contained herein constitutes ��forward-looking information�� under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as ��plans��, ��expects�� or ��does not expect��, ��is expected��, ��budget��, ��scheduled��, ��estimates��, ��forecasts��, ��intends��, ��anticipates�� or ��does not anticipate��, or ��believes��, or variations of such words and phrases or statements that certain actions, events or results ��may��, ��could��, ��would��, ��might�� or ��will be taken��, ��occur�� or ��be achieved��. Forward-looking statements in this news release include, among others, statements with respect to: the results of the PEA, including operating parameters and expected mine life, production, costs, CAPEX, OPEX, NPV, IRR, expected transportation and processing and other Project economics; plans to advance the Project, AND mineral reserve and resource estimates; Forward-looking statements are based on the assumptions discussed herein, as well as opinions and estimates of management and certain experts as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including but not limited to risks related to: uncertainties of mineral resource and mineral reserve estimates, uncertainties inherent to mining studies (such as the PEA), unexpected events and delays during construction, expansion and start-up; variations in grade and recovery rates; revocation of government approvals; timing and availability of external financing on acceptable terms; actual results of current exploration activities; changes in project parameters as plans continue to be refined; future mineral prices; failure of plant, equipment or processes to operate as anticipated; accidents; labour disputes; uncertainties inherent to conducting business in foreign jurisdictions, and in particular, developing countries, such as corruption, political instability, civil unrest, war, terrorism, crime and uncertainty of the rule of law; environmental risks and other risks of the mining industry, as well as other risk factors described in the Annual Information Form (as defined herein), the above mentioned Technical Report, and other continuous disclosure documents of the Company filed at www.sedar.com. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except in accordance with applicable securities laws.